Hotel Transactions and Valuations – What to Expect in 2022?

By Charlotte Kang, Managing Director, Valuation & Advisory Services Group, Jones Lang LaSalle

Hotels are increasingly becoming a mainstream asset class stemming from the hospitality industry’s robust growth, evidenced by the strong hotel transaction volume involving a wide array of global investors. The hospitality industry came to a halt in 2020, shocking the hotel world into a sudden and unprecedented level of uncertainty. However, the industry’s resilience prevailed as hotel investment activity made a remarkable comeback in 2021. Which brings us to the question: What are we to expect for 2022 in terms of hotel transaction activity and valuation?

This article will provide an overview of recent global transaction activity, the key drivers of that activity, and share an outlook on the state of the industry for 2022.

Hotel Transaction Volume Experienced Double-Digit Growth Through 2019

Following the Global Financial Crisis (GFC) in 2008 and 2009, the hotel sector garnered a tremendous amount of investor interest. Global hotel transaction volume grew from $26.7b to $75.9b between 2010 and 2019, representing a compounded annual growth rate (CAGR) of 12.3%

Source: JLL Research

Historically, the Americas region has attracted the largest share of hotel investment volume globally. Primarily driven by the United States, hotel transaction activity in the Americas accounted for nearly half of the annual global transaction volume, averaging 48% from 2010 to 2019. Europe, Middle East, and Africa (EMEA) attracted just over a third of total volume, averaging 35% during the same post-GFC and pre-Covid period, with the remaining hotel investment occurring in the Asia-Pacific (APAC) region. While the Americas region has the largest share of hotel transaction volume globally, APAC achieved the highest growth rate over the 2010-2019 period at a CAGR of 17.9% versus the 10.2% in the Americas; however, APAC is still a significantly smaller market than the Americas and EMEA in terms of total volume. From 2010 to 2019, the APAC region registered $98.6b in total transaction volume compared to $278b and $202b in the Americas and EMEA, respectively. Prior to the impact of Covid-19, prognosticators expected 2020 to be a strong year with respect to both hotel fundamentals and transaction volume.

Hotel Transaction Activity Lulled in 2020; Robust in 2021 with Uneven Global Distribution

The arrival of Covid-19 brought hotel investment to an abrupt halt across all regions. When the World Health Organization (WHO) declared Covid-19 a pandemic, on March 11, 2020, hotels suddenly found themselves operating in a zero to negative cash flow environment. Given the significant uncertainty looming, underwriting hotel acquisitions became nearly impossible with mainly opportunistic buyers and cash-strapped sellers willing to close the bid-ask gap to make a deal in 2020. As such, hotel transaction volume plummeted 62% to $28.8 billion in 2020, 42% of which took place during the first quarter of 2020.

Source: JLL Research

With the unprecedented amount of distress across all regions, many opportunistic buyers were eagerly waiting for the floodgates of fire sales to open at discounted prices, but that never happened. Instead, with an abundance of capital chasing hotel deals and a strong recovery in hotel fundamentals, 2021 witnessed a robust comeback. Hotel transaction volume increased by 132% from 2020 to 2021, to reach $66.8 billion, just 12% below the investment volume in 2019.

Room Revenue per Available Room (RevPAR) recovery in 2021 varied by region, ranging from 50% to 81% of RevPAR achieved in 2019, with the Americas region leading. Buoyed by a stronger-than-expected recovery in 2021 coupled with market and fiscal clarity, the Americas represented the most liquid region, accounting for 57% or $38.2 billion of global hotel transaction volume. EMEA ranked second at 26% or $17.5 billion. Additionally, the activity level seen in 2021 was supported by multiple large mergers & acquisitions (M&A) transactions, including three transactions valued at more than $2.5 billion each in the Americas and EMEA, namely the Extended Stay America and Colony Capital portfolios in the U.S. and Bourne Leisure in the U.K. By contrast, 85% of the APAC’s hotel transaction volume in 2021 was supported by stable single-asset transaction activity.

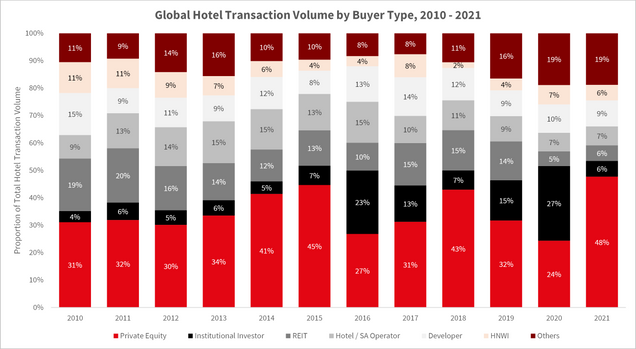

Private Equity Returned as the Dominant Hotel Buyer

Traditionally, the most dominant hotel buyer in the global markets, private equity (PE) firms, largely sat on the sidelines in 2020 representing just $7.0 billion or 24% of total global hotel transaction volume, the lowest level since 2010, as shown in the graph below. 2020 was the first and only year of the last decade that the PE share of global hotel transaction volume was surpassed by that of the institutional investors at 27%. However, with the large amount of available capital in the hands of private equity investors, they demonstrated a strong comeback in 2021, amassing 48% of global hotel transaction volume totaling $31.7 billion.

Source: JLL Research

Headwinds in the Industry

Labor shortages have been the industry’s biggest challenge in 2021. We expect this trend to continue into 2022. Staffing efficiencies have been, in large part, attainable through “opt-in” stayover service, enhanced technology such as mobile check-in, and limited food and beverage offerings. For instance, housekeeping labor expense per available room as of July 2021 was between 27% and 40% lower than they were two years ago. Rising wages will erase some of these savings. Given that hotels are labor-intensive to maintain and operate, this will have a direct impact on profitability and, in turn, asset pricing. Operators are devising creative solutions to mitigate expense increases and being vigilant in cost containment. Hotels that can demonstrate an effective labor strategy will have the highest chance of value preservation.

Source: JLL Research, HotStats

Inflationary pressure is another top challenge faced by the industry. Global inflation has intensified to the highest levels in decades in some of the world’s largest economies. Coupled with the supply chain bottlenecks, inflation is driving up hotel operating costs and this trend is expected to continue into 2022. However, hotels are the only commercial real estate asset class that prices their rental rates daily. As such, hotels can re-price their offerings accordingly in real-time and therefore are the best hedge against inflation. Additionally, many of the corporate negotiated contracts have not been re-negotiated since 2019 with no rate increases for two years. Hotels that are able to demonstrate rate resilience and strategy have the highest chance of mitigating expense creep and, in turn, preserving cash flow integrity and asset values.

Debt availability and monetary policy tightening vary by region; however, the consensus is that debt funding is returning, and monetary policy has been accommodative to aid in the market recovery. Given the concerns around increasing inflation, we do however expect monetary policy tightening and increasing interest rates. Most hotel loans are on a floating rate basis, which has an impact on the overall cost of capital and return on investment. Rising interest rates will primarily impact low-quality assets in lackluster markets the most, with values being hit the hardest, while high quality and cash-flowing investments are more insulated.

Transaction Volume To Rise with Divergent Valuation

There is a consensus that 2022 will be a strong year for global hotel transaction volume, driven by several factors.

Recovering fundamentals, not without headwinds, should create realistic expectations and narrow the bid-ask gap in 2022, which has been one of the largest roadblocks for hotel transaction consummation during the pandemic period. While leisure demand has led the recovery in the Americas and EMEA, the upside from the corporate and group travel recovery, particularly in the gateway markets, will attract increased investor interest. In the Asia-Pacific region, investors will be motivated by a renewed confidence in reopened borders, which should bolster demand and put recovery back on track. With strengthening cash flows, the lending appetite for hotels will increase, in turn fueling further hotel transaction activity.

Upcoming debt maturity could also lead to increased asset sales. In the United States, there is $31 billion worth of hotel loan debt that will mature during the 2022 to 2025 period. While lenders have generally been lenient over the past 24 months, the extensions are not anticipated to continue. Property owners could elect to sell rather than opt for refinancing. In addition, local factors could drive activity as well. As an example, China’s “three red lines” loan rules may result in developers divesting assets to improve their balance sheets in the region.

There is significant pent-up demand for real estate investments and plenty of capital from PE and REITs ready for it. For the Asia-Pacific region, PE is expected to continue to chase hotel deals in Japan and Australia, with new pools of capital emerging from EMEA that are on the hunt for lodging acquisitions. For EMEA, there is a renewed interest from international investors, particularly coming from APAC and the Middle East.

Numerous hotels deferred often necessary Property Improvement Plans (PIPs) and other capital expenditures (CapEx) and furniture, fixtures, and equipment (FF&E) needs because of Covid-19. With the ongoing market recovery and increasingly well-informed customers, either the brands or market forces are requiring assets to be renovated, and the deadline to complete is imminent. In an effort to de-risk their portfolios or improve their balance sheets, owners may elect to sell the potential upside created from such renovations to the next buyer, thus increasing the number of hotels available for sale in the market.

That said, we will likely continue to see a dichotomy of asset values across the regions. Flight to quality will continue to be the leading factor that drives competition from buyers, which in turn drives higher values in many cases. Lower quality assets with CapEx obligations will need to have a strong upside story or winning strategy to preserve values. As such, a comprehensive understanding of the asset, market demand drivers, competitive forces, management strategies, and business plans are key to the underwriting of hotel transactions in today’s complex world.

Acknowledgments

We would like to acknowledge Ingo Schweder for the peer review of this article. This article has been accepted for publication by Kaushik Vardharajan, Editor of the Real Estate issue.