2019 China-Latin America Economic Bulletin

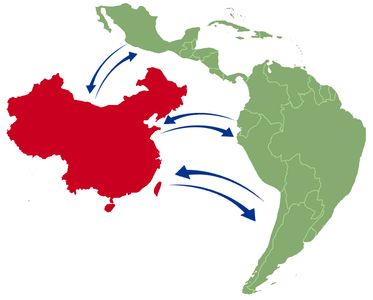

These are the findings of the 2019 China-Latin America Economic Bulletin, which brings together the most important annual trends for this burgeoning relationship in terms of trade, finance, and investment.

In 2018, China-Latin America cooperation continued to deepen, though Chinese finance and investment in the region appears to have been relatively cautious in nature. These are among the findings of this year’s China-Latin America Economic Bulletin, the sixth annual note summarizing and synthesizing trends in the burgeoning China-Latin America economic relationship. The goal of the bulletin is to provide analysts and observers a handy reference to the ever-changing landscape of China-Latin America economic relations, a landscape where data is not always as readily accessible. Highlights from this year’s edition include:

- The Latin America and Caribbean (LAC) region’s trade with China hit record levels in 2018, on both the import and export sides, which rose to 3.0 and 2.6 percent of GDP, respectively. China continues to be the most important export market for South America and remains second to the United States for exports from the LAC region overall.

- LAC’s trade balance with China improved in 2018. The region had a trade deficit of approximately 0.4% of GDP, its lowest level since 2009. This improvement was spurred by two factors: improving prices in major commodities such as petroleum oil and copper, and the trade frictions between China and the United States.

- Chinese direct investment in LAC fell in both of its avenues, mergers and acquisitions (M&As) and new (Greenfield FDI, or GFDI) projects. China-LAC M&As fell from their record level of $17.5 billion in 2017 to just $7.6 billion in 2018. Chinese GFDI in LAC fell from $4.4 billion in 2017 to just $1.6 billion in 2018, its lowest level since 2006.

- Chinese official finance rebounded slightly from $6.2 billion in 2017 to $7.7 billion in 2018. Nonetheless, this level is still among the lowest in recent years.

- Chinese finance continues to be concentrated among a few borrowing countries. However, our analysis shows that Chinese finance alone has not pushed Latin American borrowers – with the important possible exception of Venezuela – over the debt sustainability thresholds established by the IMF.

- LAC countries are rapidly joining the China-led Asian Infrastructure Investment Bank (AIIB) and the China-initiated Belt and Road Initiative (BRI). As of this writing, seven LAC countries have become prospective AIIB members and twelve have signed BRI memorandums of understanding, cooperation agreements, or framework agreements.

This China-Latin America Economic Bulletin is the sixth annual note summarizing and synthesizing trends in the burgeoning China-Latin America economic relationship. The goal of the bulletin is to provide analysts and observers a handy reference to the ever-changing landscape of China-Latin America economic relations, a landscape where data is not always as readily accessible.