Demonstrating China’s Overseas Development Finance: Webinar Summary

On Thursday, December 10, the Global Development Policy (GDP)Center hosted a webinar launch event for the new interactive China’s Overseas Development Finance (CODF) Database, featuring GDP Center Director Kevin P. Gallagher, Senior Academic Researcher Rebecca Ray, and Post-Doctoral Research Fellow, Blake Alexander Simmons.

The CODF Database is the first global, harmonized, validated, and geolocated record of Chinese development finance. It covers the years 2008 through 2019, to include equal time before and after the launch of the Belt and Road Initiative in 2013. It includes all loans from the China Development Bank and Export-Import Bank of China to governments, inter-governmental bodies, and state-owned entities. The interactive database maps 615 Chinese overseas development projects, detailing each project’s lender, year, amount, sector, and and length or total area in kilometers, where applicable. It also allows users to examine the geolocation of China’s overseas development projects and their proximity to indigenous lands, critical habitats, and national protected areas.

To begin, Ray noted that the CODF Database is the first available to feature all three of the following: global double-verification standards, a broad timeline, with years before and after the announcement of China’s Belt and Road Initiative (BRI) in 2013, and geo-location with enough accuracy for spatial analysis.

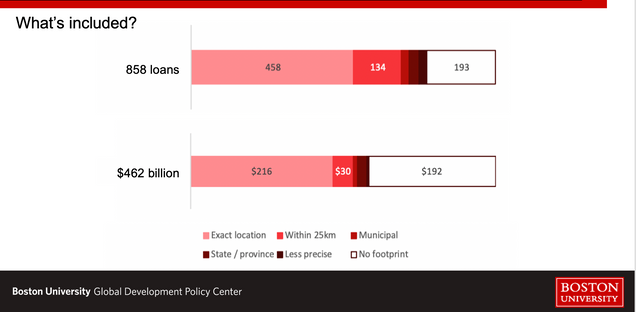

Ray then explained how many loans are included in the CODF Database, with a breakdown by type of verified location:

Figure 1: China’s Overseas Development Finance Database, Type of Loan and Location

Source:

She also elucidated some key findings, noting:

- The CODF Database shows China’s overseas lending is on par with amount lent by the World Bank during the same time period, although China’s lending varied more based on lender/borrower needs.

- Ten countries make up 60 percent of all China’s overseas lending from 2008-2019: Venezuela, Pakistan, Russia, Brazil, Angola, Ecuador, Argentina, Indonesia, Iran, & Turkmenistan. Venezuela alone accounts for ten percent of the total.

- China’s overseas lending is “an infrastructure powerhouse – in line with BRI goals.”

Simmons then discussed the ecological risks, noting that over half of all mapped projects overlapped with one or more of the sensitive territories tracked in the database: critical habitats, national protected areas, and indigenous peoples’ lands.

Next, Simmons gave a demonstration of how to use the database to search for records based on country, lender, amount, distance in length or total area, and proximity to sensitive territory.

Ray also explained the methodology and double-verification employed in creating the database, commenting that, “Double verification is at the heart of our process” and that “tracing each project’s history prevents early and over-counting”:

Figure 2: China’s Overseas Development Finance Database, Data Compilation Method

Source:

For more information on the methodology and main findings, as well as a video walk through of the database, see our blog, “Tracking China’s Overseas Development Finance.”

Gallagher then moderated a lively Q&A session with the audience afterwards, touching on topics from increasing transparency, identifying sensitive territories, and defining development finance.

The CODF Database is based on research from forthcoming academic studies. Subscribe to updates from our Global China Initiative to receive notice of publication.