Shining a Light on China’s Uneven Regional Energy Development Overseas

Although it is a massive infrastructure and connectivity program at the global scale, China’s Belt and Road Initiative does not reach all host countries equally. Regional patterns in concentration and type of projects mean that these host countries will experience the benefits – and impacts – of China’s outward investment differently.

Xi Jinping’s recent announcement at the United Nations General Assembly that China would not build new coal plants abroad highlights the differences in the kinds of energy China has supported overseas. When it comes to power generation projects where fossil energy is used, the benefits of electrification and increased grid supply can be accompanied by severe air pollution and CO2 emissions that harm the global climate. While China will not support coal going forward, it has already financed many plants that will continue to pollute for years to come. This raises an important question: which countries have used Chinese finance, investment, and contracting to further green their power grids, and which have approached their partner to further deepen fossil fuel-based power generation?

A recent GREEN journal article explores the uneven regional patterns in global power plants with Chinese involvement, by examining trends from Chinese foreign direct investment (FDI) and development finance (from the China’s Global Power Database) as well as construction arrangements with Chinese engineering, procurement and construction (EPC) companies. It shows three stark patterns in the types of energy being developed in host countries.

First, clear disparities emerge in the types of energy projects funded across regions. When comparing operational and planned coal, gas, solar and wind generation projects, it is clear that the dirtiest fuel – coal – has received the most Chinese support compared to other energy types in Asia, the Middle East and Africa. Yet, Europe, Latin America and North America have a relatively less carbon-intensive mix of Chinese-supported projects. In fact, comparing these four types of energy, Latin America has received more support for renewable capacity than fossil generation from Chinese sources.

Secondly, as the sun sets on coal, natural gas will become an increasingly important source of power generation for many countries. Prior research and advocacy have heavily focused on Chinese involvement with global coal-fired power plants, as reflected by Xi’s announcement. The GREEN journal research breaks down Chinese involvement in overseas natural gas power plants, showing that Chinese companies’ FDI supports much more natural gas than Chinese development finance, and that these companies have supported relatively more natural gas projects in Europe than other regions. Currently, information on the emissions impacts of Chinese gas FDI is lacking, representing a future area for research.

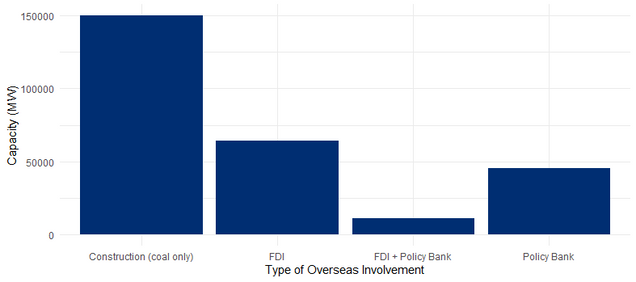

Thirdly, the data also shows that for coal plants alone, there is nearly an equal amount of power capacity contracting Chinese companies for design and construction services as there is directly receiving Chinese finance and investment for all energy types. This data indicates there is roughly 150GW of coal-fired power capacity around the world that has or had Chinese construction companies involved without receiving support from Chinese policy banks or investing companies, in addition to the 74GW of coal plants that received such support. This raises questions of how Xi Jinping’s announcement will be translated into policy, given his use of the word “build”. In addition, prior Boston University Global Development Policy Center research has shown that overseas coal plants with Chinese construction companies tend to have lower emissions intensity than similar coal plants with non-Chinese construction companies. How this occurs is not yet clear, nor is it clear the extent to which Chinese companies engage in capacity building or technology transfer with host country partners.

Figure 1: Global Coal, Gas, Wind and Solar Capacity with Different Types of Chinese Involvement

Given that China’s overseas support for coal and gas has exceeded support for renewables in most regions, it is important to understand how a future shift towards renewables could be catalyzed. Recent research from the Global Development Policy Center explored the challenges within China and host countries to increasing China’s overseas support for renewable energy. Host countries have reduced incentives for renewable energy development and implemented tariffs against Chinese renewable energy equipment, while non-hydro renewable energy companies within China have also struggled to gain support from China’s policy banks in their overseas engagement, which tend to be smaller-scale than relative to larger-scale traditional energy projects.

Despite these challenges, overseas renewable energy development represents a huge opportunity for China. China not only manufactures wind and solar power generation technology, but also related technology that can support the integration of renewables into host country power systems, like ultra-high-voltage transmission lines and energy storage technology. As China increases its focus on a green Belt and Road Initiative, and host countries build out renewable energy to meet their Paris climate commitments, there may be more opportunities for host country stakeholders to connect with interested companies or investors in China.

With China’s coal plants concentrated in Asia, the Middle East, and Africa, it is clear that communities in those regions will bear the impacts of local air pollution. At the same time, the success of Chinese renewable energy development in Latin America could generate lessons for other countries on how to work with China on clean energy. Taking a look at these regional patterns has shown that there are also emerging areas of interest, such as China’s support for natural gas plants abroad and the understanding how Chinese construction companies engage with host countries.

The distribution, as well as the scale, of China’s overseas power projects will play a role in shaping local pollution and the global climate.

Read the Journal Article