Webinar Summary: Bringing Back Brady Bonds? The Potential for Debt Restructuring in the Post-Pandemic Era

On Wednesday, September 22nd, Ying Qian, former advisor to the Asian Development Bank, joined the Fall 2021 Global China Research Colloquium for a discussion on Brady bonds and the potential for debt restructuring in the post-pandemic era.

Discussing the findings of his recent working paper, Qian explained why Brady-bond-like instruments have the potential to be used in transactions for tackling the post-pandemic period’s debt challenges. Additionally, as the Global South faces a looming debt and climate crisis, Qian says stakeholders have the unique opportunity to redirect debt into channels of new development models that promote sustainability and growth.

In the midst of a pandemic, developing countries are in more debt distress than ever before, and the degradation of the global economy will make it difficult for many of them to service their debts. Qian argued any new debt servicing program should focus on efficiency and timeliness in order to help countries regain their debt sustainability and to help creditors minimize losses. Secondly, any solution should also promote the prolonged cooperation between debtor countries and international financial partners to ensure transparency and coherent approaches for future sustained growth.

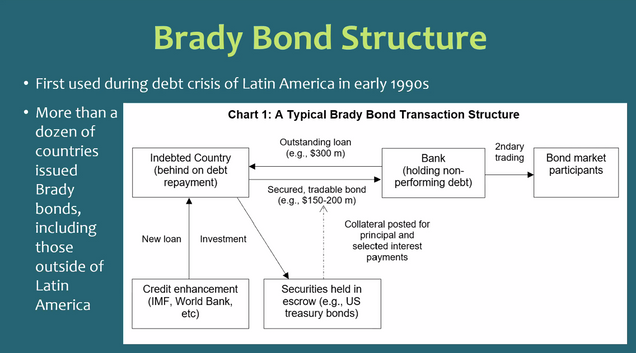

Considering both the historical and modern approaches to debt restructuring, Qian made the argument that the international institutions, states and private banks should collectively aid highly-indebted developing countries with Brady-bond-like transactions. Originally formulated to support developing countries’ debt restructuring during the 1980s-1990s debt crisis, Brady bonds were sovereign debt securities typically backed by US Treasury bonds and international institutions. But as Qian explains, the general principles applied in 1990s for Brady bonds, such as granting debt relief in exchange for greater assurance of collectability in the form of principal and interest collaterals, linking debt relief to economic policy reforms and making the resulting debt highly tradable, may still offer a solution to today’s looming debt crisis.

Though the United States was the originator of Brady bonds, Qian sees potential for China to make use of the Brady-bond-like structure to approach its outstanding debt resolution, and combine debt restructuring with green, or climate friendly initiatives. Of individual countries with an interest in conducting Brady-bonds-like transactions, China has a particularly large stake; Qian noted that Chinese creditors have significant exposure in Debt Service Suspension Initiative countries, as designated by the World Bank, and other developing countries.

During the discussion, Qian commented, “Developing countries do not really necessarily have the infrastructure in order to monitor and disclose all the benefits and costs of green finance projects. Also because of the heavy indebtedness of the countries, they may not have room for additional borrowing, even for green finance projects.” Therefore, he explained that combining debt restructuring with green initiatives could be an innovative way to address the global debt and climate crises at the same time. Nevertheless, Qian stressed that more work needs to be done to sufficiently attract investors, such as policy and institutional development and project pipeline preparation.

If applied today, another much-needed innovation to Brady-bond-like transactions would be to add on counter-cyclical state-contingent debt instruments. In particular, Qian commented that commodity linked bonds (CLBs) could be used in Brady-bond-like transactions between primary commodity producing and buying countries. As China is a significant importer of primary commodities, Chinese firms with natural hedges may be interested in investing in CLBs, which also increases CLBs’ trade-ability.

While the mounting debt crisis will require advanced coordination across financial institutions, Qian pointed out that both China and other international lenders have an interest in restructuring debt to support global financial stability. Drawing on insights from his working paper, Qian commented that, “Chinese creditors should not look at distressed debt resolution as a one-shot deal, but to collaborate with other partners to engage and work with debtor countries in broader policy and institutional development issues to help them regain stable economic growth, and become a contributing factor in the global drive for sustainable growth.”

Qian also pointed to trends that indicate a strong willingness, available funding and institutional arrangements to tackle the distressed debt situation in developing countries in the post-pandemic era, including a recent allocation of Special Drawing Rights at the IMF; expanded lending and guarantee facilities made available by the IMF, the World Bank, regional development banks and other multilateral and bilateral agencies; funds made available for green and climate change finance; and coordination mechanisms for developing country debt problems.

While the pandemic crisis has wrought immeasurable human and economic suffering, Qian says the international community has the financial tools to begin remedying the distress. Will they take it?

Read the Working Paper