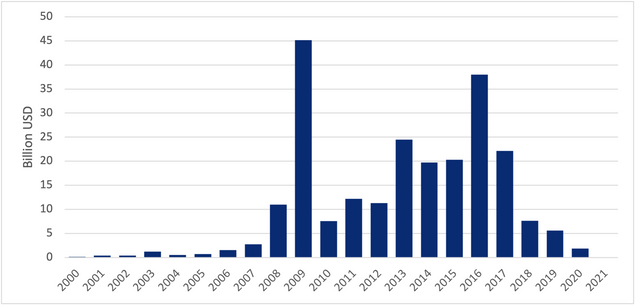

Chinese Policy Banks Gave No New Overseas Energy Sector Loans in 2021

The 2022 update to the China’s Global Energy Finance (CGEF) Database, managed by the Boston University Global Development Policy Center, recorded no new energy development finance commitments from China to foreign governments in 2021 through its two most active policy banks, the China Development Bank (CDB) and the Export-Import Bank of China (CHEXIM). This is the first year with no new reported energy commitments since the beginning of the 21st century.

While it is a dramatic statistic, a new policy brief explains why it is not an entirely surprising development. Given the persisting impacts of the COVID-19 pandemic, narrowing borrowing capacities in developing countries and the global trend towards phasing out coal, it was unlikely that Chinese overseas energy finance would continue at the same pace unabated. Ultimately, after having far exceeded energy sector lending by any other major development bank in the world for more than a decade, Chinese overseas lending has likely dropped to a level comparable to other national development finance institutions (DFIs), following an overall decrease in Chinese development finance since 2017.

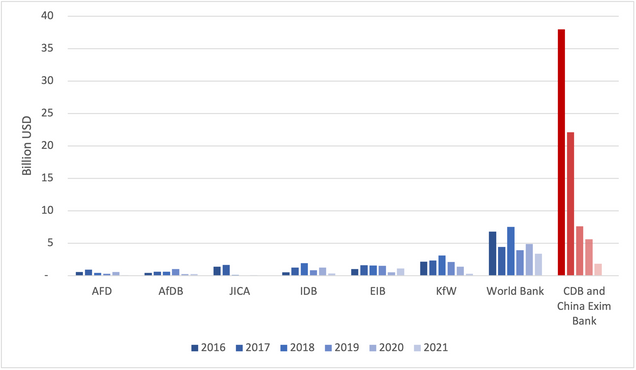

While no new loans were added in 2021, the CGEF Database records 331 loans from Chinese development finance institutions to 68 foreign governments and associated entities in the energy sector, totaling $234.6 billion since 2000. From 2016-2021 alone, energy finance committed by CDB and CHEXIM amounts to 92 loans to 37 governments worth $75.1 billion, far exceeding the next biggest energy financier among DFIs – the World Bank.

Figure 1: China’s Annual Overseas Energy Finance from Policy Banks, 2000-2021

And while development finance in general substantially increased in 2020 (especially in the health sector after the onset of the COVID-19 pandemic), most DFIs around the world also decreased new commitments in 2021. As shown in Figure 2, all DFIs surveyed reduced their energy sector lending in 2021, except for the European Investment Bank (EIB).

Figure 2: Energy Finance Commitments by Major Development Finance Institutions, 2016-2021

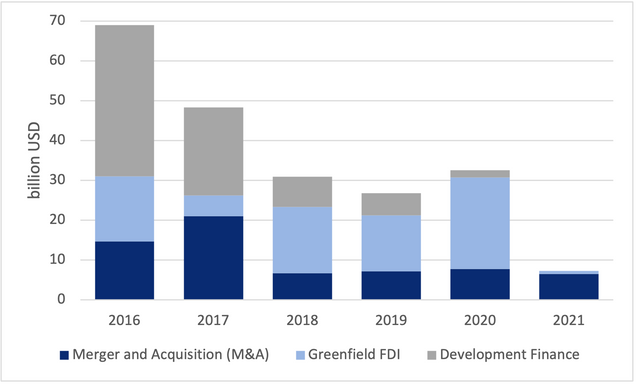

Given the lack of new energy loans in 2021, it is important to investigate how Chinese actors are engaging with the energy sector overseas through channels besides development finance. While China’s overseas energy sector development finance has decreased year by year since 2017, on average, China’s foreign direct investment (FDI) in the form of greenfield investments and mergers and acquisitions (M&A) in the energy sector has remained relatively stable, as shown in Figure 3. Indeed, FDI has gradually become China’s dominant means of capital participation in the energy sector overseas.

Figure 3: China’s Overseas Energy Investment and Development Finance, 2016-2021

There has also been a structural shift in China’s energy FDI, as the electricity sector has played a larger role since 2015, driven by a decrease in upstream fossil fuel M&As. Within the electricity sector, Chinese M&As have focused more on transmission and distribution than power generation since 2019. In addition, greenfield FDI in the electricity sector is increasingly oriented towards alternative and renewable energy. FDI for fossil fuel power generation peaked in 2015. Given Chinese leader Xi Jinping’s commitment last September to stop building new coal power projects overseas, investment in fossil fuel-based power generation will likely further decrease.

If FDI remains stable, the key question to ask is whether this trend of zero Chinese overseas energy sector lending will continue? The possibility remains for Chinese development finance to rebound in the coming years. Recent research indicates a significant relationship between Chinese outbound policy bank finance and international reserves, which have begun to rebound substantially amid record trade surpluses.

Given an increasing focus on greening the Belt and Road Initiative, one thing is clear: if and when Chinese development finance for overseas energy activity increases again, it should be directed towards cleaner sources of energy to match the trends in FDI, policy announcements and global goals for mitigating climate change.

Explore the Data Read the Policy BriefNever miss an update: Subscribe to updates from our Global China Initiative.