Avoiding Too Little, Too Late: How Asset Management Companies Can Help Resolve Developing Country Debt Distress

By Ying Qian

The year 2023 may prove devastating for Global South countries, as more and more find themselves engulfed in debt distress.

Indeed, more than 60 countries have been identified by the International Monetary Fund (IMF) as being in moderate to high debt distress or already in outright debt distress. Several countries such as Lebanon, Sri Lanka, Suriname, Zambia and Ghana are already in default, and scores of others urgently need debt relief to ward off economic collapse and sharp rises in poverty. Africa is facing a potentially serious sovereign debt problem, with

The main international debt relief offer open to some debt distressed countries is the G20 Common Framework for Debt Treatments. Debt reduction and restructuring processes in many countries have met a long and drawn-out process. Only Chad, Zambia and Ethiopia have undergone treatments, and none have concluded a restructuring more than 18 months after signing on.

The impasse has caused debtor countries difficulties in accessing international capital markets and maintaining economic growth.

Amid the stalemate, what novel approaches could be deployed to help resolve the developing country debt crisis?

In a new working paper, I argue asset management companies (AMCs) have the potential to play a key role in today’s distressed sovereign debt resolution process. AMCs are often government entities, although they can also be privately owned, set up to remove non-performing loans (NPLs) from banks’ balance sheets to preserve the viability of financial systems. Development finance institutions (DFIs), including the World Bank, can show their leadership by establishing AMC subsidiaries to purchase NPLs in debt-laden countries and work together with domestic AMCs not only on immediate debt resolution at hand, but also on creating a multi-tiered infrastructure for the distress debt market, thus helping stakeholders better prepare and adapt ahead of future crises.

How 21st century debt crises differ from those before

The emerging market debt crises are different than those of the 20th century. The banks of the past have been replaced by thousands of bondholders. Bringing commercial creditors into the debt relief process is challenging. Governments have also increasingly turned to domestic institutions as sources of finance.

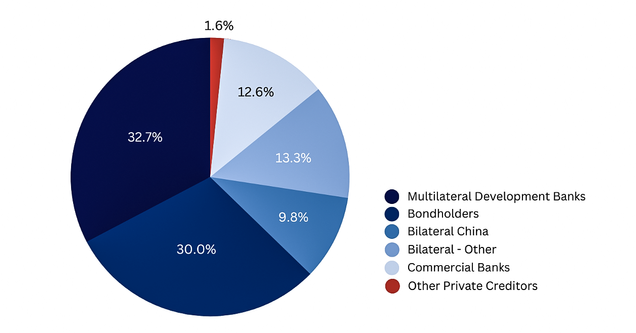

Figure 1: Distribution of Debt for 49 African Countries (2021)

The inter-play of domestic credit markets, financial sector stability, fiscal and monetary policies and public and sovereign debt can impact the effectiveness of sovereign debt workouts. Quite a few countries, like Mongolia for example, have repeatedly been through distressed sovereign debt workouts from one economic boom-and-bust cycle to another without significant improvement in public financial management and financial market development.

The AMC approach

Sometimes called the ‘good bank-bad bank’ approach, the AMC approach was applied widely in the earlier rounds of regional and global financial crises, most notably during the Asian financial crisis in late 1990s and later during the global financial crisis in later 2000s in Europe and the rest of the world. The well-known cases include the Korea Asset Management Company, the four Chinese state-owned AMCs, the National Asset Management Agency of Ireland and the Sociedad de Gestión de Activos Procedentes de la Reestructuración Bancaria of Spain. The main goal of AMCs was to maximize recovery of NPLs through asset resolution and collections. The AMCs were given by their countries’ legislatures to write off and dispose of assets at less than book value. After successfully carrying out their original mandates, many AMCs in Asia have transformed into regular non-bank financial institutions, offering a wide array of financial market intermediary services.

The merits of the AMC approach are (i) quick resolution, (ii) providing a “bridge” for the intertemporal pricing gaps which emerge when market prices for NPLs and the underlying collateral are temporarily depressed, (iii) policy, legal and regulatory reforms and (iv) niche financial institutions for NPL resolution and distressed asset management. AMCs to developing the NPL market ecosystem by creating business opportunities for NPL investors and market service agencies utilizing diverse tools of NPL resolution.

The ideal outcome for today’s distressed sovereign debt resolution would be allowing debtor countries to maintain access to international capital markets, sustain economic growth, avoid sovereign debt distress and to achieve their longer-term economic development goals. Mitigation measures will ensure prudent fiscal policy and proven debt surveillance capabilities, and good quality public debt and state asset management practices. Adaptation measures will need to have timely actions by creditors and debtors using tailor-made approaches for higher rates of recovery, and well developed legal and market infrastructure, sufficient working capital, and good professional skills for distressed debt resolution.

AMCs can play a major role in both mitigation and adaption, given their comparative advantage of being a financial and operational intermediary in working closely with debtors and creditors and other market participants to create tailor-made solutions for distressed debt. AMCs can work not only at the national level, but also at subregional, regional and global levels. The latter can be a main force in dealing with distressed sovereign debt of a country or a group of countries as required. By doing so, AMCs can help countries avoid prolonged waits which lead to more impaired loans and assets, increased difficulty in accessing international financial markets and greater economic damage. Sub-regional, regional and global AMCs can also act as agents of change to help national AMCs adopt proven principles and best practices, as well as provide financing and technical support.

Incorporating AMC operations into development finance institutions

DFIs, such as the African Development Bank (AfDB), the Asian Development Bank (AsDB) and the World Bank can play a leading role by adding AMC operations to their internal departments or through subsidiaries. Some regional platforms may also consider doing so. I estimate that the AfDB, the AsDB and the World Bank can leverage an additional $300 billion to $800 billion from their existing equity positions to fund AMC operations. In fact, the G20’s Expert Panel on the capital adequacy framework of MDBs in 2022 concluded that DFIs can start increasing their operational capacity over the next 12-24 months and several

Organizationally, the AfDB, AsDB and World Bank are well versed in financial market development issues, particularly distressed debt assets and NPLs resolution. They have vast experiences in fiscal and monetary policy related issues, as well as broader macroeconomic, legal and regulatory, governance, financial management, state-asset management, as well as climate change and green growth-related issues. Such multifaceted knowledge and operational capabilities give these MDBs an advantage to enter into AMC operations. AMCs established by DFIs either as subsidiaries or branches will not run at a loss, rather they will follow market principles and work with member governments just like their other operations. DFIs also have private sector arms which are familiar with non-sovereign operations and commercial transactions if AMCs need to engage in those. The International Finance Corporation’s (IFC) Distressed Assets Recovery Program (DARP) is a good example that supports the creation of strong distressed assets markets in emerging economies.

In addition to direct NPL workshops, the sample terms of reference for global level AMCs can include collecting best practices, sharing knowledge among peers and with national AMCs, establishing benchmarks and performance indicators, assisting in capacity development, helping debtor countries formulate strategies, policies and regulatory frameworks, developing NPL servicing infrastructure in emerging economies and mobilizing and deploying international capital for distressed assets acquisitions.

Looking forward, the pace of economic recovery from the pandemic will continue to be slow and uneven. Disruptions and trade tensions between economic power houses have placed pressure on global supply chains. The overall NPL ratio in domestic financial markets and distressed sovereign debts are likely to rise across many developing countries in coming years. Existing national public AMCs and those to be established can be tasked with resolving NPLs and avoiding a large-scale failure of financial institutions and (sub)regional and global AMCs from both public and private sectors are expected to emerge with specialized knowledge in financing, managing and resolution of NPLs.

Read the Working Paper*

Never miss an update: Subscribe to the Global China Initiative Newsletter.