Latin America and the Caribbean’s Relationship with China Rebounds with Pivot Toward Green Energy, Electric Vehicle Supply Chains

Amid a challenging global and regional context of rising interest rates, lingering effects of the COVID-19 pandemic and increasing impacts of climate change, a new report by the Boston University Global Development Policy Center summarizes and synthesizes the latest trends in the economic relationship between China and Latin America and the Caribbean (LAC).

In particular, 2022 saw a formalization and upgrade of trade relations between China-LAC, a tentative rebound of development finance amidst debt renegotiations and increasing investment in green transition supply chains.

China-LAC trade: Formalizing and upgrading

In 2022, LAC exported approximately $184 billion to China and imported an estimated $265 billion in goods from China, bringing the regional trade deficit 1.4 percent of regional gross domestic product (GDP), a new high shown in Figure 1. However, Figure 2 shows that the trade balance at the country level is more complex. Brazil, Chile and Peru maintain trade surpluses with China, while Argentina, Colombia and Mexico are experiencing deficits. Both traditional commodities, such as beef and soy, as well as new transition materials, such as lithium, dominate the region’s exports to China.

Figure 1: LAC-China Trade Balance in Goods, 2002-2022

Figure 2: Trade Balance between China and Select LAC Economies, 2002-2022

The major developments in China-LAC trade in 2022 were the announcements of new phases in formal free trade agreements (FTAs) with Uruguay and Ecuador. Uruguay and China completed a feasibility study for an FTA, the first step in a potentially long process of negotiating an agreement amidst debates within Mercosur about the permissibility of bilateral FTAs. Separately, Ecuador and China announced the conclusion of negotiations for an FTA in December 2022, capping a quick process that began with President Guillermo Lasso’s trip to Beijing in February 2022. These developments brought renewed attention to Panama and Colombia’s slower-moving FTA discussions with China. If all four agreements enter into force, it would more than double the region’s FTAs with China, though they would not surpass the United States and European Union (EU), which hold FTAs with ten and 25 LAC countries, respectively. Figure 3 shows the region’s FTAs with the US, EU and China.

Figure 3: LAC Countries with FTAs in Force with China, the European Union and the United States

These new FTAs reflect shifting regional export markets over the past two decades. Since 2001, LAC has diversified its exports markets between the EU, US and China. Brazil, Chile, Cuba, Peru and Uruguay now export slightly more to China than the EU, their main export market in 2001. Several countries’ main export markets have remained the same between 2001 and 2021, but with less dominance, as LAC economies have diversified their export markets. Figure 4 shows each LAC country’s top export market in 2001 and 2021. The depth of each color indicates how important that market is as a share of a country’s total export basket: blue countries primarily export to the US, yellow countries primarily export to the EU while red countries primarily export to China. The map shows that in general, countries in the LAC region are less heavily dependent on any single export market in 2021 compared to 2001, with the exceptions of Mexico, Nicaragua and Haiti.

Figure 4: LAC Countries’ Top Export Markets, 2001 and 2021

LAC Export Markets, 2001 LAC Export Markets, 2021

While LAC governments have emphasized the potential of these FTAs to diversify trade beyond traditional commodities, trends in LAC-China trade have raised serious concerns about re-primarization in the region, or the reversal of industrialization processes. These FTAs represent an opportunity to formalize social and environmental protections for China-LAC economic relations and secure investment in value-added export initiatives, but achieving these goals will require careful policy design and implementation on behalf of LAC countries.

China-LAC development finance: A tentative rebound amidst debt renegotiations

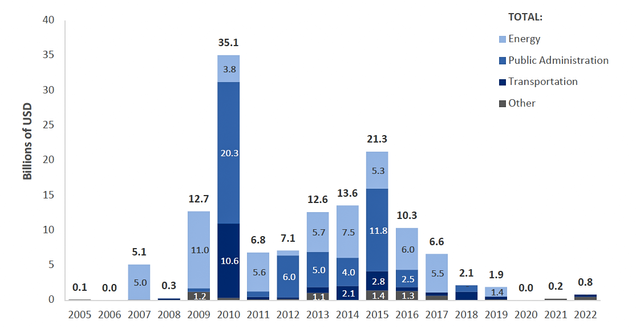

In 2022, LAC countries signed $813 million across three new loan agreements with China’s development finance institutions (DFIs), the China Development Bank (CDB) and the Export-Import Bank of China (CHEXIM) (see Figure 5). In January, the Banco do Brasil and CDB signed a $500 million agreement to support social projects such as expanding accessible housing, financing for small- and medium-sized enterprises, bolstering socioeconomic empowerment and providing access to essential services. In February, Barbados and CHEXIM signed a $115 concessional loan agreement to finance the Scotland District road rehabilitation project. Finally, in December, Guyana and CHEXIM signed a $192 million agreement for the second phase of the East Coast Road Project.

Figure 5: China’s Development Finance to LAC Countries, 2005-2022, by Sector

These new loans come amidst considerable global and regional debt sustainability challenges. In September 2022, Ecuador and China agreed to restructure $1.4 billion in loans from CDB and $1.8 billion in loans from CHEXIM, which would reduce Ecuador’s debt service payment burden by $1.4 billion through 2025. The two countries also deferred the deadline for delivery of oil as payments for previous oil-backed loans by three years to 2027, a deal which the International Monetary Fund (IMF) warns will increase Ecuador’s overall debt service payments to China by $386 million.

Investment: green transition supply chains

Chinese greenfield investment (GFDI) in new projects and mergers and acquisitions (M&As) of existing projects in LAC in 2022 were primarily in lithium, renewable energy and electric vehicles, reflecting the region’s unique positioning in the supply chain for green transition materials. China’s M&A deals, shown in Figure 6, totaled $2.3 billion in 2022, while GFDI, shown in Figure 7, reached $3.5 billion, bringing China’s total investments to $63 billion and $59 billion, respectively. Ganfeng Lithium Co. Ltd.’s $962 million purchase of Lithea Inc., an Argentinian lithium mining company, was the largest M&A deal last year. Electric automaker BYD’s announcement of a $565 million investment in three new factories in Brazil, including one for battery production, was the largest GFDI announcement.

Figure 6: Chinese M&As in LAC, by Sector, 2013-2022

Figure 7: Chinese GFDI Announcements in LAC, by Sector, 2013-2022

2022 also saw the second ever filing of an investor-state dispute settlement (ISDS) claim by a Chinese firm against a LAC state, when Hong Kong-based Junefield filed for ad hoc arbitration with Ecuador over ongoing disputes about the prior consultation process in the Rio Blanco gold mine project. An Ecuadorian court had previously halted all mining operations in 2018 after ruling that local Indigenous communities had not been adequately consulted prior to beginning operations of the project.

This claim is part of a global wave of ISDS claims filed by Chinese investors; eight of the total 15 recorded instances have been initiated since 2020. Furthermore, only one of the documented cases was initiated by a Chinese state-owned enterprise, suggesting that China-based private investors may be acting more like Western counterparts in the face of regulatory and other obstacles. As Chinese investments in lithium and other transition materials grow in coming years, LAC states will need to closely monitor these developments.

Looking ahead to the rest of 2023 and beyond

These findings indicate a tentative rebound in the areas of trade, financing and investment, although challenges remain for achieving trade diversification, debt sustainability and environmentally- and socially-sound investments in the region.

Looking ahead, commodities such as copper, iron, petroleum and soy are likely to continue to dominate LAC-China trade, though the prices of these commodities are forecasted to stall or decline in coming years. These projections, shown in Figure 8, make diversification into new supply chains all the more crucial for LAC economic prospects.

Figure 8: Commodity Prices and Forecasts, 2002-2027

Investment trends towards green transition materials are also likely to continue, with the first months of 2023 already seeing a $1 billion deal between Bolivia and a Chinese consortium to develop the country’s vast lithium reserves.

Potential new financing deals are on the horizon, with Honduras opening diplomatic relations with China in March 2023 and seeking financing to expand the Patuca hydropower complex, Argentina’s desire to expand the Cauchari solar plant in Jujuy and Bolivia’s new $350 million loan for a zinc refinery. These deals point to the rising importance of the green transition for China-LAC relations across all forms of economic engagement.

In terms of debt negotiations, Suriname, whose total public and publicly-guaranteed (PPG) debt to China is the highest in the region at 18 percent of GDP, and Argentina may seek debt renegotiation with China as part of its new IMF Extended Fund Facility negotiated in 2022.

The findings of this report suggest that new opportunities for economic collaboration are on the horizon in formalized FTAs and expanding investments in green transition materials. These trends also raise important questions about how LAC states will prevent future re-primarization, ensure debt sustainability and manage the social and environmental impacts of Chinese-funded investment projects.

Read the Report*

Never miss an update: Subscribe to the Global China Initiative Newsletter.