Global China Databases

The Global China Initiative (GCI) manages a suite of five interactive public databases that collectively track hundreds of billions of dollars in Chinese loans and investment to a variety of sectors, including energy and other infrastructure development. GCI manages and updates these databases in a bid to provide transparent information to aid research, education, policymaking, journalism and accountability with regards to China’s overseas development finance and projects around the world.

Tracking these loans has given GCI researchers the ability to study trends and work to understand China’s overseas economic activities. One of the GDP Center’s core values is to create dialogue based on empirical research, hence why these databases are made open and accessible to the public. As a resource, these data projects can help stakeholders discover more about China’s overseas lending in an interactive and engaging way.

These databases are open knowledge products and we welcome additions and corrections; reach us at gdp@bu.edu.

Read the Database Methodology GuidebookChina’s Overseas Development Finance Database

The China’s Overseas Development Finance (CODF) Database is the first global, harmonized, validated and geolocated record of Chinese overseas development finance. It covers the years 2008-2021 and includes loan commitments from China’s two main development finance institutions (DFIs), the China Development Bank (CDB) and Export-Import Bank of China (CHEXIM), to governments, inter-governmental bodies, majority state-owned entities and minority state-owned entities with sovereign guarantees. As of January 2023, the interactive database includes 1,099 loans, detailing each project’s lender, year, amount and sector. Of these 1,099 projects, 736 have precise geographic footprints, and are shown in the visual map. The remaining 363 projects without precise footprints are included in the full table of projects below the map. The database maps China’s development finance in relation to several types of socially and ecologically sensitive territories – Indigenous peoples’ lands, national protected areas and critical habitats.

The China’s Overseas Development Finance (CODF) Database is the first global, harmonized, validated and geolocated record of Chinese overseas development finance. It covers the years 2008-2021 and includes loan commitments from China’s two main development finance institutions (DFIs), the China Development Bank (CDB) and Export-Import Bank of China (CHEXIM), to governments, inter-governmental bodies, majority state-owned entities and minority state-owned entities with sovereign guarantees. As of January 2023, the interactive database includes 1,099 loans, detailing each project’s lender, year, amount and sector. Of these 1,099 projects, 736 have precise geographic footprints, and are shown in the visual map. The remaining 363 projects without precise footprints are included in the full table of projects below the map. The database maps China’s development finance in relation to several types of socially and ecologically sensitive territories – Indigenous peoples’ lands, national protected areas and critical habitats.

Suggested citation: Boston University Global Development Policy Center. 2023. China’s Overseas Development Finance Database. Retrieved from http://www.bu.edu/gdp/chinas-overseas-development-finance/.

Explore the Database Read the 2023 Policy Brief Read the 2022 Journal Article on Methodology Read the 2022 Journal Article on Risks to Biodiversity and Indigenous LandsChinese Loans to Africa

The Chinese Loans to Africa (CLA) Database is an interactive data project tracking loan commitments from Chinese development finance institutions (DFIs), commercial banks, government entities and companies to African governments, state-owned enterprises and regional institutions.

The CLA Database was started by the China Africa Research Initiative at Johns Hopkins University’s School of Advanced International Studies (SAIS-CARI). As of March 29, 2021, the CLA Database is managed by the Boston University Global Development Policy (GDP) Center.

Starting in 2007, researchers have collected, cleaned and analyzed publicly available data to create a database on Chinese lending to Africa. The data sources include official government documents, contractor websites, fieldwork, interviews and media sources.

The CLA Database estimates that from 2000-2022, 39 Chinese lenders signed 1,243 loan commitments amounting to $170.08 billion with 49 African governments and seven regional institutions. CLA Database loan amounts are not equivalent to African government debt, as the database tracks commitments, and not disbursement, repayments or defaults.

Suggested citation: Boston University Global Development Policy Center. 2023. Chinese Loans to Africa Database. Retrieved from http://bu.edu/gdp/chinese-loans-to-africa-database.

Explore the Database Read the Policy BriefChinese Loans to Latin America and the Caribbean Database

The Chinese Loans to Latin America and the Caribbean (CLLAC) Database tracks loans China’s development finance institutions, China Development Bank (CDB) and Export-Import Bank of China (Ex-Im Bank), to Latin American and Caribbean governments and state-owned enterprises. This database is the product of collaboration between the Inter-American Dialogue and the Boston University Global Development Policy Center.

The Chinese Loans to Latin America and the Caribbean (CLLAC) Database tracks loans China’s development finance institutions, China Development Bank (CDB) and Export-Import Bank of China (Ex-Im Bank), to Latin American and Caribbean governments and state-owned enterprises. This database is the product of collaboration between the Inter-American Dialogue and the Boston University Global Development Policy Center.

In 2023, the CLLAC Database recorded two loans to just one LAC country (Brazil) totaling $1.3 billion, representing a slight increase in lending from the $863 million issued by CDB and Ex-Im Bank to the region in 2022.

Suggested citation: Ray, Rebecca and Margaret Myers (2024) “Chinese Loans to Latin America and the Caribbean Database,” Washington and Boston: Inter-American Dialogue and Boston University Global Development Policy Center. Retrieved from: https://www.thedialogue.org/map_list/.

Explore the Database Read the 2024 ReportChina’s Global Energy Finance Database

The China’s Global Energy Finance (CGEF) Database tracks and displays the overseas energy finance provided by China’s two major development finance institutions (DFIs)—the China Development Bank (CDB) and the Export-Import Bank of China (CHEXIM).

Since the year 2000, Chinese DFIs have provided an estimated 331 loans worth $225 billion in energy sector financing to 65 foreign governments. These commitments are international sovereign loans, which means the recipient is a public entity, public majority owned or a private entity with a sovereign guarantee on a loan.

For the year 2022, the CGEF Database recorded a total of zero new energy sector loan commitments from CDB and CHEXIM to government borrowers, signifying two consecutive years of no new lending.

Suggested citation: Boston University Global Development Policy Center. 2023. China’s Global Energy Finance Database. Retrieved from http://www.bu.edu/cgef.

Explore the Database Read the Policy BriefChina’s Global Power Database

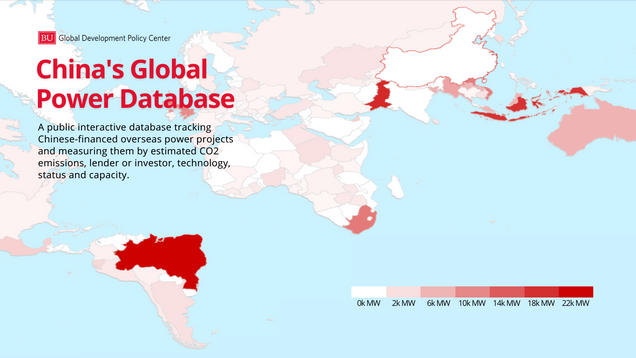

The China’s Global Power (CGP) Database tracks global power plants outside of China financed by Chinese foreign direct investment (FDI) and/or China’s two global policy banks, the China Development Bank and the Export-Import Bank of China. The database also tracks and displays the deal types, Chinese investors and/or lenders, percentage of ownership by investor, amount of capacity in megawatts, type of technology, operating status and the estimated annual CO2 emissions of the power plants.

The China’s Global Power (CGP) Database tracks global power plants outside of China financed by Chinese foreign direct investment (FDI) and/or China’s two global policy banks, the China Development Bank and the Export-Import Bank of China. The database also tracks and displays the deal types, Chinese investors and/or lenders, percentage of ownership by investor, amount of capacity in megawatts, type of technology, operating status and the estimated annual CO2 emissions of the power plants.

As of mid-2022, Chinese capital has supported 648 power plants overseas, representing 1,423 individual power generating units providing a total of 171.6 GW of power generation capacity. Among these power plants, Chinese capital participation includes FDI in the form of greenfield investments or mergers and acquisitions and debt finance.

Suggested citation: Boston University Global Development Policy Center. 2022. China’s Global Power Database. Retrieved from https://www.bu.edu/cgp/.

Explore the Database Read the Policy Brief Read the Methodology NoteChina Overseas Finance Inventory Database

The China Overseas Finance Inventory (COFI) Database is a comprehensive database covering Chinese equity and debt investments in the power-generation sector across 76 Belt and Road Initiative countries. It consolidates nine different source databases to include the transaction details of 473 investments in 430 power plants. The database is a collaboration between the Boston University Global Development Policy Center, the Inter-American Dialogue, the China-Africa Research Initiative at Johns Hopkins University and World Resources Institute.

Key data points for financial transactions in COFI include the financial instrument (equity or debt), investor name, amount and financial close year. Key technical characteristics tracked for projects in COFI include name, installed capacity, commissioning year, country and primary fuel type.

The database is available for download through Open Data Portal.

Explore the Database