GEGI Data Interactives

The Global Economic Governance Initiative (GEGI) manages several data interactives tracking sovereign debt, national climate funds, the global economic recovery effort from COVID-19 and beyond. The interactives are updated regularly with information and analysis regarding economic ramifications, implications and current policy shortcomings. As a resource, the interactives and their attendant research papers can help align global economic governance with development and climate ambitions and deliver green and inclusive prosperity.

Below, explore our data interactives.

Sovereign Debt and Environment Profiles Database

A cycle of extreme weather, financial instability, unsustainable debt levels and high costs of capital are limiting fiscal space at precisely the moment that a dramatic, stepwise increase in climate and conservation investments is needed to achieve the United Nations 2030 Sustainable Development Goals (SDGs) and Paris Agreement targets.

The Sovereign Debt and Environment Profiles (SDEP) Database is a new interactive data project tracking debt stress and capital market constraints as relative to climate investment needs, conservation investment opportunities and green finance opportunities.

The SDEP Database allows users to explore the fiscal constraints and green investment opportunities of 114 emerging market and developing economies.

Suggested citation: Boston University Global Development Policy Center. 2024. Sovereign Debt and Environment Profiles (SDEP) Database. Retrieved from http://www.bu.edu/gdp/sovereign-debt-environment-profiles-database.

Explore the Data Read the BlogClimate Negotiations Database

Since the United Nations (UN) General Assembly launched negotiations on climate change in 1990, there have been recurrent rounds of discussions to make and remake global climate rules. Countries negotiated and adopted the United Nations Framework Convention on Climate Change (UNFCCC), the Kyoto Protocol and the Paris Agreement. Between the treaties, major decisions set new approaches to reducing emissions and established new institutions.

There is now a broader understanding of climate change that has expanded to include issues beyond reducing greenhouse gas emissions. Yet, there is not a sound empirical understanding of how negotiations have evolved to address an increasingly wide range of issues relevant to climate change.

The Climate Negotiations Database attempts to understand what climate talks have focused on and how the volume of work has changed by categorizing negotiation agenda items starting in the first Conference of the Parties (COP) of the UNFCCC in 1995. The Climate Negotiations Database was last updated in November 2023.

Explore the Interactive Read the Journal Article Read the Blog

National Climate Funds Tracker

![]() This interactive is the first-of-its-kind in assessing the national-level funding vehicles established to mobilize domestic and international climate finance. It identifies 154 funds across 99 countries and shows how these funds vary by host country, legal design, scope, mobilized finance and the level of success in attracting resources from multilateral climate funds. The interactive also tracks whether NCFs work with multilateral climate funds, such as the Green Climate Fund (GCF) as implementing or executing entities. The NCF Tracker provides the operating context for developing country actions on climate change. The NCF Tracker was last updated in November 2023.

This interactive is the first-of-its-kind in assessing the national-level funding vehicles established to mobilize domestic and international climate finance. It identifies 154 funds across 99 countries and shows how these funds vary by host country, legal design, scope, mobilized finance and the level of success in attracting resources from multilateral climate funds. The interactive also tracks whether NCFs work with multilateral climate funds, such as the Green Climate Fund (GCF) as implementing or executing entities. The NCF Tracker provides the operating context for developing country actions on climate change. The NCF Tracker was last updated in November 2023.

Global Financial Safety Net Tracker

![]() The Global Financial Safety Net (GFSN) Tracker is the first global interactive database that measures the annual lending capacity of the International Monetary Fund (IMF), central banks and regional financial arrangements (RFAs) and the total amount of financing to combat the COVID-19 crisis via loans from the IMF, RFAs and currency swaps. The interactive is co-produced by Freie Universität Berlin, the Boston University Global Development Policy Center and the United Nations Conference on Trade and Development (UNCTAD). The GFSN Tracker was last updated in July 2024.

The Global Financial Safety Net (GFSN) Tracker is the first global interactive database that measures the annual lending capacity of the International Monetary Fund (IMF), central banks and regional financial arrangements (RFAs) and the total amount of financing to combat the COVID-19 crisis via loans from the IMF, RFAs and currency swaps. The interactive is co-produced by Freie Universität Berlin, the Boston University Global Development Policy Center and the United Nations Conference on Trade and Development (UNCTAD). The GFSN Tracker was last updated in July 2024.

Suggested citation: Mühlich, Laurissa, Barbara Fritz, William N. Kring, Marina Zucker-Marques, Natalia Gaitán. 2024. “Global Financial Safety Net Tracker.” Retrieved from https://www.bu.edu/gdp/global-financial-safety-net-tracker/index.html.

Explore the Interactive Read the Blog Read the Database Methodology GuidebookThe IMF COVID-19 Surveillance Monitor

One of the core activities of the IMF is to oversee the international monetary and financial system and monitor the economic and financial policies of its 190 member countries, known as surveillance. To measure the extent to which IMF country surveillance since the start of COVID-19 has identified risks and mitigation measures to help borrower countries improve health outcomes, support vulnerable people and firms and address climate change, the GDP Center and the United Nations Conference on Trade and Development (UNCTAD) designed an interactive data project, the IMF COVID-19 Surveillance Monitor.

One of the core activities of the IMF is to oversee the international monetary and financial system and monitor the economic and financial policies of its 190 member countries, known as surveillance. To measure the extent to which IMF country surveillance since the start of COVID-19 has identified risks and mitigation measures to help borrower countries improve health outcomes, support vulnerable people and firms and address climate change, the GDP Center and the United Nations Conference on Trade and Development (UNCTAD) designed an interactive data project, the IMF COVID-19 Surveillance Monitor.

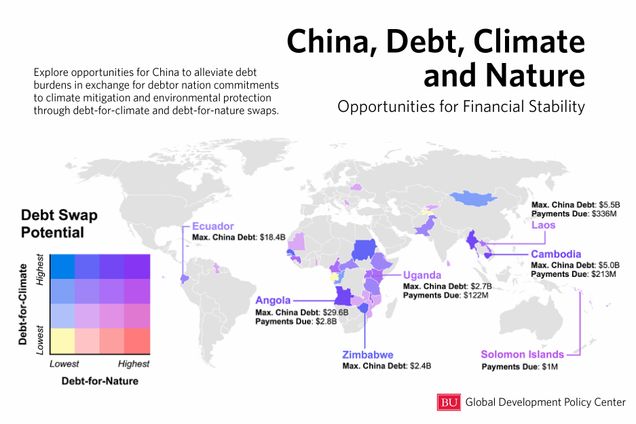

China, Debt, Climate and Nature: Opportunities for Financial Stability

This interactive explores opportunities for China to alleviate debt burdens in exchange for debtor nation commitments to climate change mitigation and/or adaptation and environmental protection through “debt-for-climate” and “debt-for-nature” swaps. In the Global Outlook homepage, users can view the characteristics of the 41 countries assessed according to their potential for debt-for-climate and/or debt-for-nature swaps with China. Additionally, in the Explore tab, users can create maps and scatterplots with the data from our analysis (including financial, environmental, and opportunity data) to see how these characteristics vary between countries, and how the relationships between different variables may be useful for prioritizing countries for green debt relief strategies. In the Data tab, users can find a description of all the variables included in this interactive, as well as the original sources for the data. In the About tab, learn more about this project and read a more detailed guide on how to utilize all the features on this site.

Suggested citation: B. A. Simmons, R. Ray, H. Yang, K. P. Gallagher (2021) China can help solve the debt and environmental crises. Science 371: 466-468.

Explore the Interactive Access the Journal Article Read the BlogThe IMF COVID-19 Recovery Index

The IMF COVID-19 Recovery Index is an updating inter-active data project that measures the extent to which the International Monetary Fund (IMF) recommends, or conditions borrowing countries increase efforts to combat the COVID-19 pandemic, protect vulnerable people and firms, and stage a green recovery in accordance with/from official speeches and directives from IMF leadership and fiscal guidance notes produced by the IMF Fiscal Affairs Department. The Recovery Index is a composite based on three equally weighted scores for each IMF country program: health, protecting the vulnerable, and a green recovery, as discussed in Gallagher and Maldonado Carlin (2020). This interactive allows the user to browse the IMF‘s overall score and its component parts, as well as overall scores and component parts for each borrowing country. The closer the total composite or independent component is to three, the more attention and support the IMF is giving to public health, vulnerable people, and a green recovery. The Index will be regularly updated on an ongoing basis, and was last updated in March 2021.

Suggested Citation: Gallagher, Kevin P and Franco Maldonaldo Carlin (2020), “The Role of IMF in the Fight Against COVID-19: The IMF COVID-19 Response Index,” COVID Economics, CEPR Press, Issue 42, 19 August 2020.

Explore the Interactive Read the Blog