Coal Region Economic Transformation in China

Four years ago, in 2016, I was honored to post an inaugural blog for the Boston University Institute for Sustainable Energy. The blog tells my personal story of how I witnessed the economic ups and downs of my hometown city Wuhai (not to be confused with Wuhan) in Inner Mongolia, the number one coal-producing province in China, whose economy heavily relies on coal. The blog was written at a time when Inner Mongolia was in the middle of an economic depression. China’s economy entered the new normal. The severe air pollution problem caused smog issues in many cities in the country. The government shut down many coal-fired boilers and started to accelerate clean energy development. Coal demand in China plummeted, so did Inner Mongolia’s economy.

Four years later, where is Inner Mongolia’s economy now? Was it able to drag itself out of the predicament?

In this blog, I will continue to zoom in on my hometown city in Inner Mongolia, Wuhai, giving an update on where its economy is today while revealing its past and the current efforts to diversify its economy from coal mining in the past two decades.

Today’s Economic Status in Wuhai

As mentioned in my previous blog, “Wu Hai” in Chinese means something elegant: the sea of black gold. Wuhai has abundant black gold, coal. It was a city built as a coal supplier to a steelmaker in 1958 and designated as a city officially in 1976. After decades of development, today Wuhai has a population of about 560,000, similar to the population in Atlanta, Georgia. While Atlanta is considered a large city in the U.S., Wuhai is a small city in China compared to other cities in China. Below is a picture of where it is located in China.

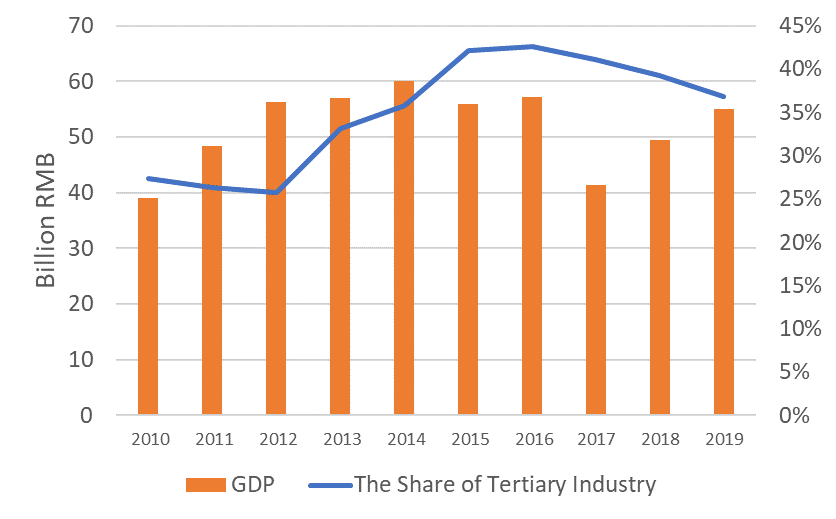

To give a sense of Wuhai’s economic status today, let us look at some numbers. As shown in Figure 2 below, after the economic increase until 2014, Wuhai experienced drops in GDP in 2015-2017, but then started to bounce back in 2018 and 2019.

These economic ups and downs may still be attributed to coal production changes. For example, while Wuhai’s historical coal production data in recent years is not available to my knowledge, data from Inner Mongolia Statistics Bureau indicates that coal production in Inner Mongolia in 2018-2019 went up from 2017, consistent with the GDP increase in Wuhai during this period.

However, Figure 2 also shows that Wuhai’s economic structure has changed over the years. The share of the tertiary industry was 37% in 2019, up from 27% in 2010, despite the decline in recent years. In particular, the tourist industry is booming and has been growing rapidly in recent years with a 25.8% annual average growth rate of tourism revenue. In 2018, Wuhai received visits from 3.5 million people and the revenue from the tourist industry reached 7.6 billion RMB (about 1.1 billion USD).

In addition, the non-coal industry now accounts for about 70% of the total industrial output value with more than 50 types of industrial products. The proportion of coal mining job employment in the total job employment of the secondary and tertiary industries dropped from 24% in 2013 to 12% in 2018 (Source: Wuhai statistics Bureau, Main Data Report of the National Economic Census of Wuhai City in 2013 and 2018).

These numbers seem to suggest that while the economy in Wuhai is still reliant on coal production to some extent, it is moving away from coal with a more diversified economy. How did Wuhai achieve this? As it turns out, Wuhai’s efforts to diversify from coal mining started two decades ago and have taken several stages of transformation rooted in the contexts of domestic and international movements.

First Transformation: Coal Mining → Heavy Chemical Industry

Wuhai’s first attempt to diversify from coal mining happened in 1998. State-owned coal companies were under severe profit losses. The operations were inefficient, there was limited transportation capacity to export coal to other regions, and the coal companies were over-burdened with societal responsibilities (e.g. building and managing hospitals and schools) under the planned economy. The lives of roughly 60,000 employees became extremely difficult as their wages were not paid for as long as 13 months.

This was also a time when state-owned companies across China faced similar profit loss issues and the government took measures of unprecedented huge layoffs. Triggered by the Asia financial crisis in 1997, about 6 million employees from state-owned companies were laid off in 1998 alone and a total of 13 million in 1998-2003.

To reduce the reliance on coal, Wuhai started to introduce the heavy chemical industry. Wuhai’s cheap coal, electricity, and other mineral resources such as industrial salt and limestone gave it the competitive advantage to develop this industry. It helped Wuhai to address the issue with limited railroad transportation by consuming coal and electricity generated by coal locally. It was also effective in promoting GDP growth because it is capital intensive. Pollution was an issue, but the priority then was to keep the economy going and people surviving. In addition, there was little pressure for climate change domestically and internationally back then.

With favorable economic incentives from the city government, such as low electricity prices and tax rebates, and the development of industrial parks to provide the infrastructure needed by new manufacturing plants, Wuhai’s heavy chemical industry took off. This was also the period when China started to explore the development of the heavy chemical industry.

Over the past two decades, Wuhai built four industrial parks that host about four hundred companies across many industries dominated by the coking industry, chlor-alkali industry, and fine chemical industry. These industries gradually grew and became the new engines to power the economic growth in Wuhai.

Second Transformation: Heavy Chemical Industry → New Coal Chemical Industry

After the Asian financial crisis in 1998, China’s economy began to recover and accelerate. The real estate market was heating up rapidly, driving up the demand for coal, steel, cement, and so on. Coal became a hot commodity, and Wuhai soon entered a golden period of development starting from early 2000. GDP growth was in double-digits from 2000-2013, including during the 2008 economic crisis. People got rich overnight and piles of money awaited anyone who could dig the black gold out of the ground.

The rebound of China’s economy also drove up the demand and prices for other energy resources, including oil and natural gas. However, China does not have abundant domestic oil and gas resources and so must rely on imports from international markets. When international oil prices skyrocketed to US$160 per barrel during the 2008 economic crisis, out of its concern for energy supply security China determined to develop the coal chemical industry that uses coal as the feedstock to make other petrochemical products instead of oil and natural gas.

This was also when Wuhai began to develop the coke chemical industry. The coke chemical industry uses the waste products of the coal coking process, such as coal tar and coke oven gas, to make chemical products such as black carbon and liquefied natural gas. This kind of process enhances the economic values of the coking companies (by retaining economic values from what used to be waste products) and the downstream chemical industries (by lowering the cost of raw material inputs). Environmentally, it also helps to reduce the pollution issues associated with releasing coal tar and coal gas from the coking process.

Today, Wuhai has emerged as the nation’s important coal coking chemical industry base. It has the capacity to deep process two million tons of coal tar. All coal oven gas from the coking processes is collected and used for downstream processes locally or sold to neighboring regions through pipelines as industrial feedstock.

Third Transformation: New Coal Chemical Industry → Strategic Emerging Industries

The economic miracle in Wuhai in the 2000s didn’t last forever. In 2013, China’s economy entered a new normal. The air pollution issue became so severe that the government shut down inefficient coal-fired boilers. Coal demand decreased. Many businesses suffered again in Wuhai and people were laid off. Accompanying the economic recession was the devastated environment. Lots of lands were mined in the rush to dig the “gold” so that the ground cracked. Some houses became too dangerous to live and the vegetation was severely damaged. The water and air were heavily polluted by industrial wastes and pollutant emissions from energy-intensive industries. Meanwhile, Wuhai was designated as a “resource depletion” city in 2011 after more than two decades of relentless mining.

Obviously, Wuhai must further reduce its dependence on coal and find a way to grow the economy in an environmentally sustainable way.

To reduce the air pollution issue, the government in Wuhai requires higher efficiency and environmental standards and shut down small-scale inefficient and highly polluting productions in the energy-intensive industries, coking plants, coal washing plants, and coal mines. To fix the damage to the land and mountains, Wuhai invested in greening the coal mines with replanting. In 2018, Wuhai started to work with the United Nations on the first pilot project to explore and demonstrate how to develop the green and sustainable mining industry.

Wuhai is also gearing itself toward high-tech industries, new emerging industries, and clean energy industries. It already attracted lots of investments domestically and internationally for advanced material industry (e.g. manufacturing materials used in lithium batteries by using the coal tar from its coke chemical industry), the LNG truck assembly industry, the hydrogen industry, and so on.

All of these build on Wuhai’s existing industries but upgrade or extend to strategic emerging industries. For example, hydrogen is a byproduct of the chlor-alkali industry, therefore developing the hydrogen industry improves the economic competitiveness of both the chlor-alkali and hydrogen products and further reduces the city’s reliance on coal mining. With abundant solar and wind resources, Wuhai has the potential to produce hydrogen using the electricity generated by renewables, which will further enhance the life-cycle carbon emissions of the hydrogen production process.

Fourth Transformation: Heavy Industry → Tertiary Industry

In recent years, Wuhai’s eyes and minds have also opened to discover some other hidden resources it had for centuries but had largely ignored.

It was unthinkable ten years back that Wuhai could become a tourist city one day. Wuhai is part of the Inner Mongolia high plateau and located at the intersection of three major deserts, which bring to Wuhai wind and sand in a dry climate – a perfect recipe for sandstorms. But that has changed since the Haibo Bay water conservancy project was finished in 2014.

The project helps the city to deal with its flooding issue and provide clean electricity. Equally important, it created a reservoir called Wuhai Lake that dramatically improved the climate and ecosystem in Wuhai and completely changed its natural landscape. Once viewed as a place that “even birds don’t want to shit on,” Wuhai is now the habitat for some migratory birds such as red-billed gulls. Like a dragon now bestowed with eyes, Wuhai’s natural scenery has magically changed with the beautiful waterfront view surrounded by wing-flapping birds, backed with mountains, and bordered with deserts. This not only benefits local people with a much-improved living environment but also provides Wuhai with the opportunity to develop its tourist industry.

To boost its tourist industry, Wuhai is unlocking its resources all around to attract tourists. The “all but barren” deserts now become the hosts for desert racing contests and sand games. The Mongolian history and culture buried under the desert ground is also awakening and contributing to the tourist industry.

The same is true for the grape industry. Once with next to no economic value, Wuhai’s grape industry now employs more than ten thousand people thanks to government supporting policies. Four wine-making companies produce multiple wine brands sold in China and other countries. Moreover, the vineyard is open to visitors as tourist sites, much like the winery tourism industry in the Napa Valley region of California, bringing additional revenue for the tourist industry.

The Road Ahead

Born with coal in its veins, Wuhai tasted the sweet and the bitterness of this black gold through the ups and downs. The pain was severe during the downtimes and forced Wuhai to seek a future not solely reliant on coal. Wuhai seems to be surviving those hardships with a more diversified economy.

It started with coal mining as the sole industry, but now is extending and expanding to non-coal industries, including strategic emerging industries. It initially relied on a high-energy consumption and high-pollution development model but is now transforming and upgrading to a more efficient, higher-quality, and sustainable development model. It began with coal as the only resource endowment to live on, but now with open eyes and minds is tapping into other hidden resources to diversify the economy away from coal.

Wuhai paid substantial environmental costs on its path to industrialization due to high energy consumption and high pollution development. The severe environmental damages still need a long time to be repaired. And it still has a long way to go when it comes to keeping the balance between economic development and environmental protection in the future. It still needs to address the climate change issues associated with its coal industry.

There will be other challenges ahead. While the coal chemical industry may have its opportunity to help address the national energy security concern, its economic viability is heavily influenced by oil and natural gas prices. As the world enters the era of low oil and natural gas prices, the extent to which the coal chemical industry helps promote economic growth is uncertain. Water resource scarcity is another limiting factor for the coal chemical industry due to its large water consumption.

Amid all the challenges and uncertainty is the certainty that Wuhai has to continue its path to move away from coal. Hopefully, Wuhai will learn from the lessons in the past, keep its eyes and minds open, and continue the entrepreneurial initiatives to transition to an environmentally sustainable economy.

Acknowledgments

I would like to sincerely thank Max Dupuy, Hengwei Liu, Peter Fox-Penner, Justin Ren, Ira Shavel, Weicheng Shi, Xiaowei Xuan, Xueliang Yang, and Jiantuo Yu for their review, feedback, and suggestions for this article.

—Dr. Yingxia Yang, Senior Fellow at the Boston University Institute for Sustainable Energy and Senior Technical Leader at Electric Power Research Institute

The opinions expressed herein are those of the authors and do not necessarily represent the views of the Boston University Institute for Sustainable Energy.