Ruling Capital Reviewed in San Francisco Book Review

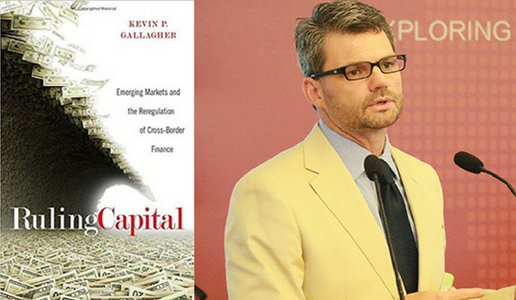

Ruling Capital: Emerging Markets and the Re-Regulation of Cross Border Finance by Kevin Gallagher, Professor of Global Development Policy at the Frederick S. Pardee School of Global Studies at Boston University, was recently the focus of an article by the San Francisco Review of Books.

In the book, Gallagher demonstrates how several emerging market and developing countries (EMDs) managed to reregulate cross-border financial flows in the wake of the global financial crisis, despite the political and economic difficulty of doing so at the national level.

The review was published in the San Francisco Review of Books on July 10, 2017. From the text of the review:

Among the victims of the financial crisis were emerging economies, caught in the downdraft of Western mismanagement and lack of regulation. The flow of capital in and out of their countries became an issue as their currencies rose along with unemployment. Depending on the country, its agreements, its economy and its politics, changes, restrictions and regulations began to appear and have effects. Ruling Capital examines this phenomenon in a broad sweep around the world.

You cannot have an adjustable monetary policy, a fixed exchange rate and unfettered capital mobility at the same time (the “impossible trinity”). Countries are forever juggling them as conditions change. At the same time, pairs and groups of countries always try to set rules for them in treaties. The United States, and its proxies the IMF and World Bank, are standout examples.

As in so many instances, the inflexibility of the IMF distorted economies and made client countries uncomfortably restricted in their actions. It seems that the IMF’s role is to get countries to self flagellate in exchange for support, for the ultimate benefit of the big western economies. The fund’s one size fits all policies have never proven valid, and Gallagher demonstrates how several key emerging countries employed workarounds and loopholes to shore up their economies. Grudgingly, even the IMF had to agree they worked (in 2012). Gallagher is more than fair with the IMF, as impartial as is humanly possible, and ignoring details of the damage done to countries all over the world.

The problem is not straightforward; it is more of a cobweb. Countries can implement controls with certain others according to agreements (trade and financial), with them, or with groups of them (OECD, WTO, FTAs, etc). It makes having a consistent policy almost impossible, as tugs from all directions pervert plans.

Kevin P. Gallagher is a professor of global development policy at Boston University, where he co-directs the Global Economic Governance Initiative (GEGI). GEGI’s mission is to advance policy relevant research on governance for financial stability, human development, and the environment on a global scale. You can follow him on Twitter @KevinPGallagher.