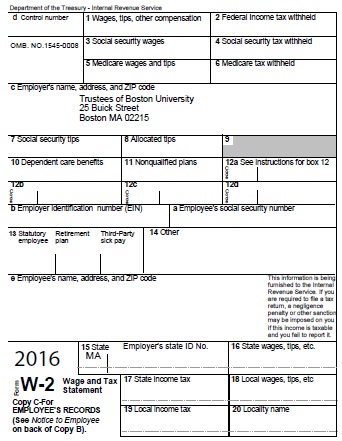

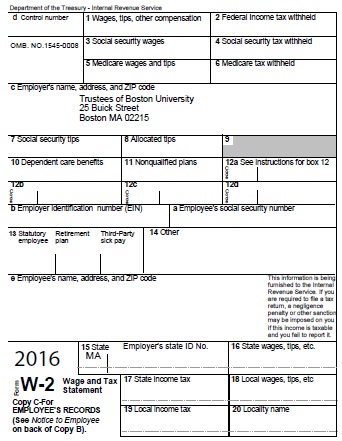

Understanding Your W-2

The following information is intended to answer the most frequently asked questions regarding the content and distribution of your W-2, which is needed to file income tax returns.

Explanation of Boxes

Box 1 - Wages, Tips, Other Compensation

- This is the taxable amount reported to the Internal Revenue Service (IRS). It includes any taxable fringe benefits (such as tuition remission benefits greater than $5,250), gifts, bonuses, taxable moving, as well as the taxable value of group-term life insurance in excess of $50,000 (see box 12, below). It excludes all pre-tax deductions including: Pre-tax medical, dental, 403(b), flex spending, parking and transportation from your gross wages.

Box 2 – Federal Income tax withheld

- This is the total amount of federal income tax withheld from your wages during the calendar year.

Box 3 - Social Security Wages

- The applicable limit on Social Security wages in 2017 is $127,200. Income subject to the Social Security tax is not reduced by your contributions to a retirement plan (403(b)), but is affected by all other pre-tax deductions, which include parking, healthcare, flex spending, etc. The only applicable exceptions are BU student employees working at BU while enrolled full-time and attending classes, as well as nonresident alien employees visiting the U.S. for a limited period on F-1, J-1, M-1 or Q-1 visas and performing services to carry out the purpose for which such visas have been issued.

Box 4 - Social Security Tax Withheld

- The Social Security tax rate for 2017 is 6.2%, and a matching amount of 6.2% is paid by BU. The only applicable exceptions are BU student employees working at BU while enrolled full-time and attending classes, and nonresident alien employees visiting the U.S. for a limited period on F-1, J-1, M-1 or Q-1 visas and performing services to carry out the purpose for which such visas have been issued.

Box 5 - Medicare Wages and Tips

- There is no applicable limit on Medicare wages in 2017. Income subject to the Medicare tax is not reduced by your contributions to a retirement plan (403(b)), but is affected by all other pre-tax deductions, which includes parking, healthcare, flex spending, etc. The only applicable exceptions are BU student employees working at BU while enrolled full-time and attending classes, and nonresident alien employees visiting the U.S. for a limited period on F-1, J-1, M-1 or Q-1 visas and performing services to carry out the purpose for which such visas have been issued.

Box 6 - Medicare Tax Withheld

- The Medicare tax rate is 1.45% on the first $200,000 of income and 2.35% on income above $200,000, and a matching amount is paid by BU. The only applicable exceptions are BU student employees working at BU while enrolled full-time and attending classes, and nonresident alien employees visiting the U.S. for a limited period on F-1, J-1, M-1 or Q-1 visas and performing services to carry out the purpose for which such visas have been issued.

Box 10 - Dependent Care Benefits

- BU must report the pre-tax amount paid into a dependent care flexible spending account as part of the BU Benefits Plan. Only dependent care benefits are reportable. Other pre-tax deductions withheld under the Benefits plan are not reportable.

Box 12 - Codes

- The Codes shown in box 12 are described below.

- C Taxable cost of group-term life insurance over $50,000 (included in Boxes 1, 3 (up to $127,200), 5 and 16.

- E Elective deferrals under a salary reduction agreement for the Tax Sheltered Annuity 403(b) Program.

- P Excludable moving expense reimbursements paid directly to employee (not included in Boxes 1, 3, 5, or 16).

- BB Designated Roth contributions under a salary reduction agreement for the Tax Sheltered Annuity 403(b) Program.

- DD Cost of employer-sponsored health coverage including the employee and employer share. These amounts are not taxable.

Box 13 - Checkboxes

- The “Retirement plan” box must be checked if you contributed to any of the University’s tax deferred options. Thus, all BU Employees who fall into this category will have an X in this block. By checking the “Retirement plan” block, an employer notifies the IRS that an employee’s eligibility for a deductible Individual Retirement Arrangement (IRA) is limited.

Box 15 - State

- This box identifies the state your wages are reported to.

Box 16 - State wages, tips, etc.

- The amount of your wages subject to state tax. This amount might differ from the amount shown in Box 1.

Box 17 - State income tax

- The amount of tax withheld for the state in Box 15.

Box 18 - Local wages, tips, etc.

- The amount of your wages subject to local income tax.

Box 19 - Local income tax

- The amount of tax withheld for the locality in Box 20.

Box 20 - Locality Name

- The city or town that also withheld taxes.

Common W-2 Questions

Why do the year-to-date gross wages on my last December paycheck not match the Box 1 wages on my W-2?

- Gross year-to-date wages on your paycheck include all compensation paid to you. Box 1 on your W-2 reports taxable federal withholding wages, including:

|

Total Compensation |

| Plus (+) |

Imputed Income |

| Less (-) |

403(b) deductions [see below] |

| Less (-) |

Other pre-tax deductions [see below] |

What is included in Total Compensation?

- Total Compensation is your base pay plus any additional income amounts paid during the tax year.

What is imputed income and how does it apply to me?

- The IRS requires that certain benefits provided by BU be reported as taxable compensation – such as taxable tuition remission, certain types of moving expenses, and the value of employer-paid group term life insurance in excess of $50,000.The IRS requires that some types of imputed income are also to be reported in Box 12. For example, the taxable value of your BU-paid group life insurance (also known as a type of “Imputed Income”) is reported in Box 12 as code C. Taxable tuition (one type of imputed income included in Box 1 wages) is not reported separately in Box 12.

How are my 403(b) Retirement Plan contributions reported on the W-2?

- Under IRS section 403(b), certain employee retirement deductions can be excluded from federal taxable wages. Pre-tax contributions to the BU 403(b) Retirement Plan are excluded from federal taxable wages. They are listed under box 12 of your W2 with an “E” code. Elective after-tax 403(b) contributions (Roth) are included in federal taxable wages. After-tax contributions are listed under box 12 with a “BB” code. Employer contributions are not reported in the Form W-2.

What are “other pre-tax deductions?”

- Under IRS regulations, certain types of employee deductions can be made on a pre-tax basis. At BU, these deductions include:

- Medical, dental

- Personal and Family Accident Insurance

- Flexible spending account contributions (both Health Care and Dependent Care)

- Health Savings Account contributions

- Transportation

- Parking

Why does the amount in Box 1 (federal taxable wages) of my W-2 form not match Box 3 (Social security taxable wages) and/or Box 5 (Medicare taxable wages)?

- Each type of tax has a different definition for taxable wages:

Box 1 = Total Compensation + imputed income – 403(b) deductions – other pre-tax deductions. (No maximum)

Box 3 = Total Compensation + imputed income – other pre-tax deductions. (The 2018 maximum is $128,400)

Box 5 = Total Compensation + imputed income – other pre-tax deductions. (No maximum)

Where are my Dependent Care FSA contributions shown on my W-2?

- If you contributed to a Dependent Care FSA via payroll deductions, your contributions are reported in Box 10.

How do I request a W-2 Form from prior years?

- For tax years 2014 and forward, active employees can log into ESS and print a copy of their W-2 forms.

- Active employees can also request W-2 forms by completing the duplicate W-2 request form.

- Former employees should email bupay@bu.edu to request duplicate W-2 forms.

How can I print my W-2 Form from my own computer?

- First, log into Employee Self-Service and click “W-2 Display” under the “Benefits & Pay” heading (make sure your browser will allow pop-ups from BUworks.

- Click on the year of the W-2 you wish to print.

- Print the .pdf document.