Monthly Caps on Out-of-Pocket Costs Could Provide Financial Relief to Privately Insured Patients.

Monthly Caps on Out-of-Pocket Costs Could Provide Financial Relief to Privately Insured Patients

Nearly a quarter of commercially insured patients could see their healthcare bills for medications and other services drop by 50-60 percent with a $500 monthly limit on in-network, out-of-pocket costs.

The Biden’s administration’s Inflation Reduction Act has been dubbed “game-changing” legislation for seniors on Medicare, as the bill provides a slew of cost-cutting healthcare measures, including phased-in annual caps on out-of-pocket (OOP) costs and a $35 monthly cap on insulin.

But Congress failed to approve a proposal to extend these cost-saving measures to the broader US population that is covered by employer or other private insurance—which includes many patients who are also struggling to afford the rising costs of insulin and other critical medications or healthcare services.

Now, a new study led by a School of Public Health researcher has found that placing a monthly, rather than annual, cap on OOP costs for these commercially insured patients could lower their highest monthly healthcare bills by 50-60 percent.

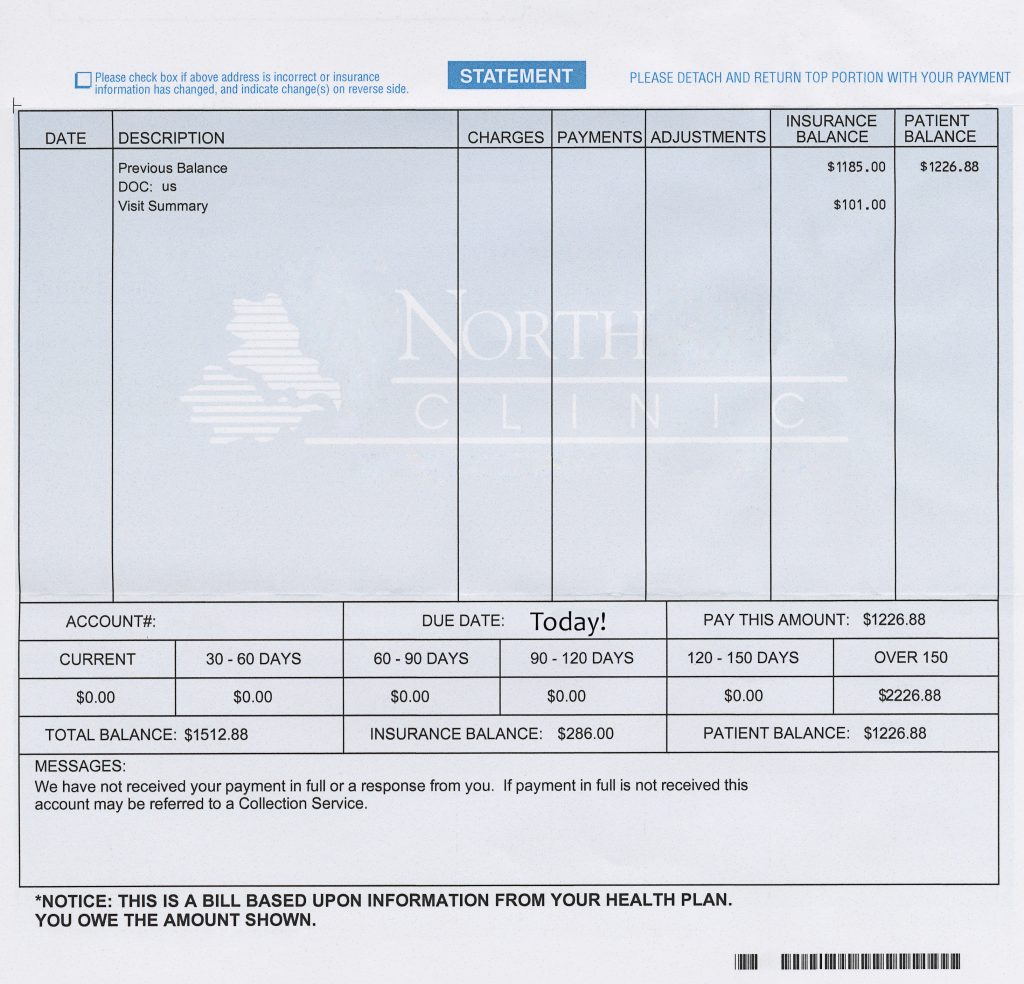

Published in the journal JAMA Network Open, the study showed that instituting a $500 monthly limit for in-network, out-of-pocket costs on private insurance plans could lower healthcare and prescription drug spending for nearly 25 percent of commercially insured patients, with the median highest monthly costs decreasing from $1,139.80, or 56 percent. Patients with higher deductibles and lower incomes would benefit the most from this cap, which would make it easier for them to manage the cost of monthly prescriptions or expensive treatments during visits to the doctor.

The results showed that decreases in OOP costs would be even more pronounced with a $250 monthly limit for in-network care, with median highest monthly bills reduced by more than 60 percent.

High OOP costs can cause patients to delay or miss care, or skip their medications. Plans with smaller deductibles each month would provide many patients a substantial amount of financial relief and enable them to adhere to expensive and life-saving prescriptions, or seek other necessary care.

“Even though the Affordable Care Act made it a lot easier for people to get and afford health insurance, many people are ‘underinsured’—they have coverage, but can’t afford to use it because the deductibles and other cost-sharing are too high,” says study corresponding author Paul Shafer, assistant professor of health law, policy & management. “Instead of having a deductible of thousands of dollars per year that must be met before your plan pays anything, it could be capped on a monthly basis—this way, the cost hurdle in January is no different than the one in December, and you aren’t penalized by starting your deductible over if you change jobs mid-year.”

The monthly caps could lead the big savings throughout the course of the year, beyond just the worst months. The $500 monthly limit, which would have affected about 25% of enrollees, reduced in-network OOP costs over a whole year by 46 percent while the $250 limit, affecting nearly 37% of enrollees, showed a 51 percent reduction.

The researchers emphasize that insurance plans would have to absorb the extra OOP costs, but that this would be mostly offset by employers (who pay most of the cost of employer coverage) and the federal government (premium subsidies in the Marketplace) rather than patients bearing the full cost. They estimated that annual plan costs (and thus, premiums), would likely increase by a little more than 5 percent per enrollee with a $500 monthly limit and about 8 percent for $250.

But a monthly cap on OOP costs is not the only solution to rising healthcare costs, Shafer says, adding that this measure should complement other cost-cutting approaches, such as prices negotiations for prescriptions and healthcare services.

“We have lots of evidence that high out-of-pocket costs are a barrier to filling prescriptions, staying up-to-date with preventive care, and following through on other recommended care,” he says. “This is a Band-Aid on higher prices for healthcare and prescription drugs, and rising deductibles—part of making it better, but not the whole solution.”

The study’s senior author is Stacie B. Dusetzina, associate professor of health policy at Vanderbilt University Medical Center. The study was coauthored by Michael Horny, assistant professor in the Department of Radiology and Imaging Sciences at Emory School of Medicine, and in the Department of Health Policy and Management at Rollins School of Public Health.