“Hold on, I have to post this on Instagram”: Trends, Talk, and Transactions of the Experiential Consumer

By Steve Kent

“The universe is made of stories, not of atoms.”—Muriel Ruckeyser

Just a few years ago, consumers proudly showcased material purchases of the latest fashion accessory or technological gadget. Now they are more likely to post online about experiences, rather than the consumption of products. This ‘experiential economy’ and the consumers that characterize it are real phenomena and are showing up in travel trends, industry conversations, and even in transactions. Social media communications about where people stay, eat, and visit is the content that gets the most ‘likes,’ and it enables consumers to share experiences and stories with friends. By its very nature, hospitality is a natural beneficiary of these trends in consumption—but how can the industry target audiences to capitalize financially on experiences?

The concept of the ‘experiential consumer’ is a broad category characterized by the intangibility of experiences. Staying in a hotel room that faces the ocean, playing craps at a packed casino, or tasting new foods in an exotic locale cannot be replaced with technology or the purchase of a good or product online. Nevertheless, even within experiential consumption, there are different responses. Think about it—do you get more “likes” when you check into a restaurant, share a photo of your entrée, or post a photo of enjoying your dinner? Each one of these actions progressively captures the experience more fully. The photo in Figure 1 received a higher amount of likes because it showed full immersion. If an experience is vibrant and visible, hospitality leaders need to work on ways to encourage their patrons to engross themselves in the experience, fully share it, and create a circle of awareness.

While an experience may not be fully replaced with technology, disruptors that target the experiential consumer and economy do exist. For example, Airbnb’s website states: “Homes, experiences, and places—all in one app.” By announcing up-front that Airbnb is going to offer an experience, do they have an advantage over a hotel that just offers a room? Incumbent industry leaders like Hyatt have already targeted this local and experiential market with investments in OneFineStay.com. With its extensive inventory of vacation rentals and timeshares, Wyndham also has focused on this market for some time.

Experiential consumers are an arena in which incumbents and disruptors inevitably will face off, in part because the opportunity they represent is so significant. One of the examples of how the disruptors might be focusing on the experiential consumer more aggressively than incumbents is their social media interactions. While most leading hotels have active feeds, they tend to feature photos of their buildings, physical amenities, and employees. Conversely, on Airbnb’s social media, they tend to show photos of their consumers experiencing travel. Although is difficult to tell whether this focus is by design (and further, whether it leads to more interest and bookings), it illustrates Airbnb’s consumer focus on the experience. Such postings by the incumbents might also be a function of these larger branded hotel chains’ focus on corporate travel, where they feel compelled to showcase their physical product to meeting organizers rather than the firsthand interaction.

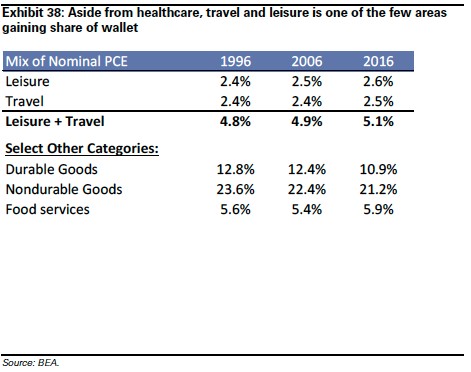

Table 1. Travel and leisure are two of the few areas gaining share of wallet.

Source: BEA, 2016 Note: Healthcare not included in survey.

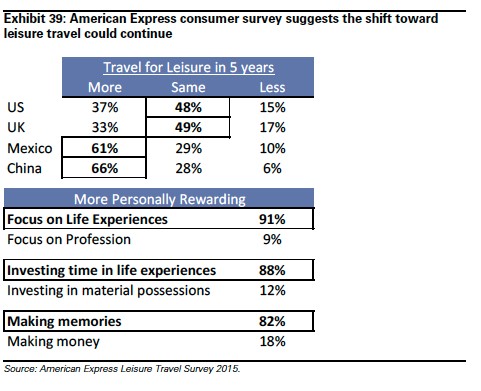

Table 2. Shift toward leisure travel projected to continue.

Experiential consumer trends illustrate why leading hospitality companies need to more aggressively target this opportunity. Recent research by Goldman Sachs (Grambling, Prykull, Stone, & Singh, 2016) presented the preceding two charts to illustrate that “consumer spending preferences in the US appear to be taking the next evolution from good then services to more experiences.” The first chart is from the US Bureau of Economic Analysis, which measures nominal personal consumption expenditures on goods and services and provides a more detailed breakdown of where the dollars go. The chart shows that as a percentage of overall spending, leisure expenditure has gone from 2.4% of wallet in 1996 to 2.6% in 2016, and during the same period, travel has gone from 2.4% to 2.5%. As a percentage of wallet, these two categories have increased, while products like durable and non-durable goods have declined. Healthcare may be one of the only other services that has increased during this period. Table 2 was from the American Express Leisure Travel Survey 2015. As illustrated in the table, leisure travel and the pursuit of enriching life experiences is not just a US-centric theme: the tables shows that respondents in Mexico, China, and the UK all appear to have a higher desire for life experiences, and travel is part of that.

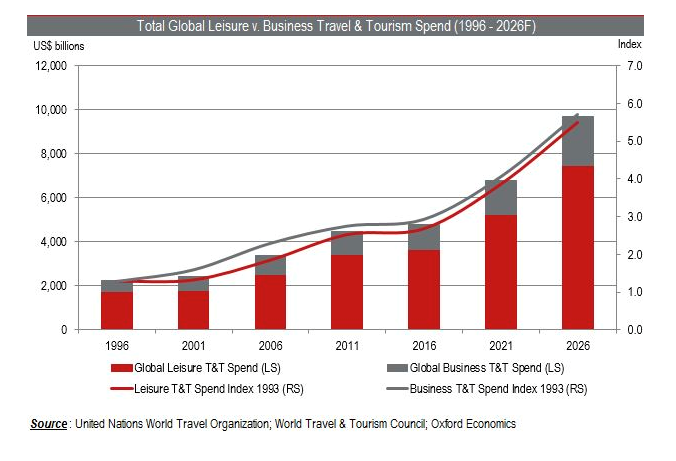

The shift toward more leisure and experiential travel has also been discussed in the IPO documents for Playa Resorts from September 27, 2016 (SEC Edgar/Playa Hotels, 2016). The text explains that global travel and tourism spending totaled $7.2 trillion in 2015. The United Nations World Travel Organization (UNTWO) further estimates that between 2006 and 2016, global travel and tourism spending grew by a compound annual growth rate of 3.6% and, per the World Travel & Tourism Council (WTTC), is expected to accelerate to a 7.2% compound annual growth rate over the next decade, outpacing the 6.2% compound annual growth rate projected for the global economy according to Oxford Economics.

Leisure travel and tourism spending in 2015 specifically accounted for 76.6% of total global travel and tourism according to the UNWTO. The WTTC anticipates that leisure travel and tourism spending will grow more quickly than business travel spending over the next ten years, thus benefitting those destinations with more resort- and/or leisure-oriented lodging options. Over the next decade, the compound annual growth rate for the leisure segment is projected to grow at 4.2%, compared to a 3.7% compound annual growth rate for the business travel segment. While low-cost airfares, greater disposable income, and easier access to credit might be factors, we would postulate that the experiential consumer trend is a key factor in this acceleration of spending (SEC Edgar/Playa Hotels, 2016).

Hotel data also suggests the importance of the experiential consumer to industry growth. In 2015, industry-wide RevPAR (revenue per available room) grew 6.2%, but resort-specific RevPAR grew 7.9%, and Orlando (a key leisure experiential destination) also grew 9.0%. In 2016, resorts appear to once again top the broader market with a RevPAR gain of 3.8%, versus 3.2% for the total industry (STR, 2016).

Affirmations of the rise of the experiential consumer are illustrated by commentary of industry leaders indicating how the trend has been a critical driver of recent successes. For example, when announcing that Cedar Fair, a leading amusement park company, saw record attendance and revenues through Labor Day this past summer, company CEO Matt Ouimet noted, “As consumers continue to prioritize experiences over possessions, we believe we are well positioned” (Cedar Fair, September 7, 2016). Other hospitality leaders have echoed this sentiment. Notably, Steve Holmes, CEO of Wyndham, told investors in his opening comments for third quarter 2016 earnings results that even though economic conditions may be soft, “people around the world are committed to spending time with loved ones. They’re looking for unique experiences at all price points and we believe that our diverse portfolio of travel offerings can continue delivering on that growing demand” (Wyndham, October 26, 2016). Howard Schultz recently described the Roastery at Starbucks, their newest higher-end roasting and tasting outlet, as based in experience. He specifically suggested that the Roastery was not just about a great cup of coffee, but ultimately a full immersion, adding that “the primary thing we’re learning is that the Reserve bar…where all the coffee is made in multiple brewing methods…has created excitement, interest, education, romance, theater, but it also has created the opportunity for us to provide our customers with a different coffee experience and, candidly, at a higher ticket” (Starbucks, November 3, 2016).

While trends and quotes illustrate the shift to the experiential economy, we are also seeing that “money talks.” In just the past three months, private equity firms have started to take a renewed interest in experiential travel opportunities, specifically resort locations as well as all-inclusives. On November 8, 2016, the private equity firm KSL Capital Partners announced they were acquiring Outrigger Hotels and Resorts, which operates or has under development 37 properties with approximately 6,500 rooms located in Hawaii (Oahu, Maui, Kauai, Hawaii Island), Guam, Fiji, Thailand, Mauritius, and the Maldives. Marty Newburger, partner at KSL, noted that “for nearly seven decades, the Outrigger team has been focused on providing authentic, localized experiences for guests in iconic resort destinations” (KSL, 2016).

On December 13 of the same year, two transactions—specifically, deals for Playa Hotel and Apple Leisure—illustrated investor interest in operations that target the experiential consumer. Playa Hotels & Resorts B.V. (“Playa”), a leading owner, operator, and developer of premier all-inclusive resorts, announced on this date that it had entered a definitive business combination agreement with Pace Holdings Corp., a special-purpose acquisition company sponsored by an affiliate of leading private equity firm TPG. Playa has 6,142 rooms across its 13 locations and owns and operates all-inclusive resorts located on prime beachfront properties in leading destinations like the Dominican Republic, Jamaica, and Mexico (Playa, 2016).

The very same day, KSL Capital Partners and KKR agreed to acquire Apple Leisure, “the nation’s top seller of all-inclusive vacation packages” (Apple Leisure, 2016). The company’s subsidiaries include “AMResorts (hotel management and marketing services), Amstar (the largest destination management company for Mexico and the Dominican Republic), a portfolio of travel distribution brands (Apple Vacations®, Travel Impressions®, CheapCaribbean.com®), and the exclusive Unlimited Vacation Club travel program” (Apple Leisure, 2016). The experiential consumer shift is not the only reason for these transactions. However, it illustrates an interest in dealmakers to target businesses that may appeal to people who are looking not just for room with a view, but also a room with activities, exotic food, cultural immersion—and maybe even partying. These are experiences and not things that can be duplicated or bought by somebody else; however, they can be shared and communicated through digital channels. If the experience exceeds expectations, then it could lead to greater brand awareness and likely greater demand.

The shift toward experiential spending versus consumption has been emerging for some time, and hospitality leaders appear to be welcoming this shift based on the trends, talk, and transactions. Over the next several years, we expect leaders to showcase not just the rooms but also the living—not just the price but also the promise of an adventure. Travel and leisure are natural beneficiaries of this evolution within the industry, and we challenge executives to work on ways to more aggressively embrace it rather than just experience it.

Steve Kent has over 25 years of experience as a senior financial analyst in a variety of business sectors, most recently as a managing director for Goldman Sachs specializing in the hospitality industry. Since 1998, he has been annually recognized for his work by Institutional Investor magazine. Additionally, the Wall Street Journal has recognized him eight times for successful stock picks. In 2005, he was awarded Volunteer of the Year by New Society of Analysts. He has also addressed senior management and leaders at Marriott International, Wyndham Hotels, World Travel and Tourism Council, and the American Gaming Association.Steve graduated magna cum laude from SUNY Stony Brook with a bachelor’s degree in economics. He took his first job in the Economic Research Department at Goldman Sachs. In 1990, he completed his MBA while working as a junior analyst for Donaldson Lufkin and Jenrette. After graduating, he returned to Goldman Sachs where he worked for over 25 years. He received his Chartered Financial Analyst designation in 1994. He lives in Long Island, New York with his wife and daughter.

References

-

Apple Leisure Group/KKR/KSL Capital Partners. (2016, December 13). Apple Leisure Group to Be Acquired by KKR and KSL Capital Partners [Press release]. Retrieved from http://www.kslcapital.com/press-room/apple-leisure-group-to-be-acquired-by-kkr-and-ksl-capital-partners.html

-

Bureau of Economic Analysis. (n.d.). Retrieved from https://www.bea.gov/iTable/iTable.cfm?reqid=12&step=1&acrdn=2#reqid=12&step=3&isuri=1&1203=2014

-

Cedar Fair Entertainment Company. (2016, September 7). Cedar Fair Announces Record Attendance and Revenues Through Labor Day [Press Release]. Retrieved from http://ir.cedarfair.com/newsroom/press-releases/news-release-details/2016/Cedar-Fair-Announces-Record-Attendance-And-Revenues-Through-Labor-Day/default.aspx

-

Grambling, S., CFA, Prykull, C., CFA, Stone, R., & Singh, N. (n.d.). Americas Lodging: Initiate at Neutral: Late cycle leaves us below consensus, valuation reflective; Buy MAR, Sell LQ (p. 20, Rep.). New York, NY: Goldman Sachs.

-

(2016, November 04). Starbucks (SBUX) Q4 2016 Results – Earnings Call Transcript. Retrieved from http://seekingalpha.com/article/4019416-starbucks-sbux-q4-2016-results-earnings-call-transcript?part=single

-

(2016, October 26). Wyndham Worldwide’s (WYN) CEO Stephen Holmes on Q3 2016 Results – Earnings Call Transcript. Retrieved from http://seekingalpha.com/article/4015294-wyndham-worldwides-wyn-ceo-stephen-holmes-q3-2016-results-earnings-call-transcript?part=single

-

-

Outrigger Hotels and Resorts (Outrigger) /KSL Capital Partners, LLC. (2016, November 8). Outrigger Hotels and Resorts and an affiliate of KSL Capital Partners, LLC enter acquisition agreement [Press release]. Retrieved from http://www.kslcapital.com/press-room/outrigger-hotels-and-resorts-and-an-affiliate-of-ksl-capital-partners,-llc-enter-acquisition-agreement.html

-

Playa Hotels & Resorts B.V./Pace Holdings Corp. (2016, December 13). Playa Hotels & Resorts and Pace Holdings Corp. Announce Business Combination [Press release]. Retrieved from http://www.businesswire.com/news/home/20161213005637/en/Playa-Hotels-Resorts-Pace-Holdings-Corp.-Announce

-

United States, SEC. (2016, September 27). SEC/Edgar/S-1/Playa Hotels and Resorts, B.V. Retrieved from https://www.sec.gov/Archives/edgar/data/1618182/000119312516721736/d246339ds1.htm

-

Vacation Rentals, Homes, Experiences & Places. (n.d.). Retrieved from https://www.airbnb.com/?af=43720035&c=A_TC%3Dfmeb9dyr2w%26G_MT%3De%26G_CR%3D100808697856%26G_N%3Dg%26G_K%3Dairbnb%27%26G_P%3D%26G_D%3Dc&atlastest5=true&gclid=CKKSsuurldECFVtLDQodRGcHCg