Terriers’ Takes on Elizabeth Warren’s Student Loan Relief Plan

How much it would help depends on family income

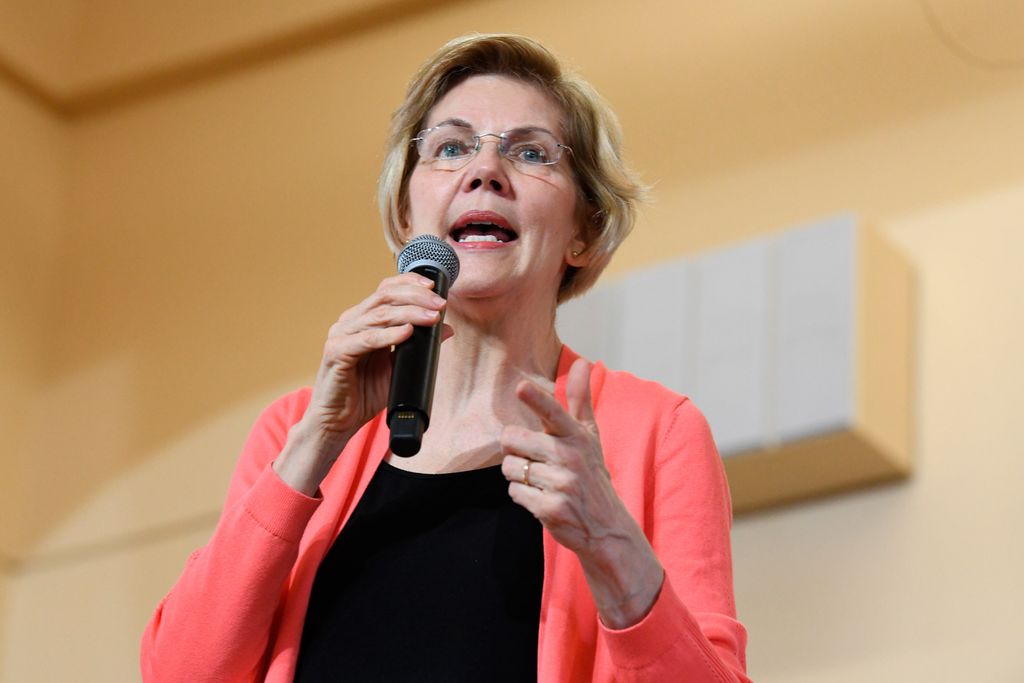

A lifeline to debt-burdened college students and graduates? Or welfare for the well-off? There are two ways to view Democratic presidential candidate Elizabeth Warren’s college debt forgiveness plan.

The proposal by the US senator from Massachusetts would forgive up to $50,000 in college debt for people with household incomes of less than $100,000, while those with incomes between $100,000 and $250,000 would have part of their debt canceled. Those with incomes over a quarter million dollars would receive no benefit. (Warren coupled the plan with a proposal to make public universities and colleges tuition-free.) It’s estimated that three quarters of all college borrowers would have their debt wiped out.

BU Today found students receptive to Warren’s proposal, especially those struggling with debt in the high five figures or more, working multiple jobs, or thinking about postponing things like graduate study.

Here are snapshots of four Terriers who shared their debt experience (comments edited for length).

Andrea, College of Arts & Sciences senior

Major: Political science

College debt? As of now, I owe $23,968, including interest that will accrue.

How has this debt influenced your choices? The debt has affected my decisions in what kind of food, shoes, and clothes that I buy. Ideally, I would want to become a lawyer. Currently, I am studying for the LSAT. I plan to take it this upcoming September and apply early. Despite the financial struggle, I would like to become a lawyer, even if I might have to pay a huge amount of debt. I worked very hard to come here, so I want to finish at a place that I’ll be proud of.

How would Warren’s plan affect you? I think Warren’s plan would be life-changing, because I won’t have to delay going to grad school. After I graduate, I plan to take some time off until I can afford law school. I hope I can save up enough within five years. (The LSAT score expires within five years.)

Abby Schofield, CAS junior

Major: Archaeology

College debt? Before this year, I owed around $25,000 in loans and will probably graduate with about $45,000 in debt. Both my parents and I contribute to paying for my college, but I have more loans than they do at this point. I borrow both federal and state grants and loans and have one merit scholarship.

How has this debt influenced your choices? I definitely was concerned when choosing archaeology, because it requires at least a master’s and most definitely a doctorate, so I was worried about the expense of that. Additionally, archaeologists need to travel to dig sites in order to gain experience, and those programs can be anywhere from $3,000 to $7,000, and grants are very hard to come by. I’m waiting to finish school before making any plans, because I am not sure when an opportunity may come along. But I am also worried about job security, since it is a very small field.

How would Warren’s plan affect you? Warren’s plan would partially knock out my debts. This would be helpful, because I can put more money into my education going further. I also know that this will be really beneficial to people who do not have the support I was fortunate to have. I think it is important that every person should have the opportunity to go to college without money being a worry. Education should not be a privilege. This plan wouldn’t affect me as much as it would others, but I would still be grateful for it. Education is beneficial for society as a whole. I understand the criticisms against the plan. I would be bitter, too, if I were not grandfathered in to this kind of system and had to work hard to pay off all my loans. However, the price of college has increased exponentially since our parents’ generation, and government funds for education should reflect this.

Donald Allen Sarra (CAS’18)

Major: Economics and mathematics

College debt? I currently have upwards of $75,000, but once all is said and done, with interest I would’ve paid over $100,000.

How has this debt influenced your choices? I had to work every semester in college—more than one job—to be able to pay a little bit of my student loans while in school. If this debt didn’t exist, I would certainly be less apprehensive about taking the next step and going to graduate school for law. However, I have to settle for however long, because I know I will have to take student loans for law school.

How would Warren’s plan affect you? Sen. Warren’s plan would greatly increase my opportunity and ability to save money. Currently, I am saving nothing and am afraid that if I lose my job, I would be in deep financial trouble.

Katie Camero (COM’19)

Major: Journalism

College debt? I owe about $38,000 in student loans, and I only borrowed from the feds. But this amount will surely double after interest [over the coming] years. I was lucky to have a scholarship from BU my freshman year. Even then, I still owed about $6,000 out of pocket each semester, which was nearly impossible for my family and me. It scares me when I think about how many years will be spent trying to pay off my loans while an unnecessary amount of interest accumulates in the meantime.

How has this debt influenced your choices? I tried to borrow from private lenders, but my family’s credit has suffered from so many years of debt that it was impossible to receive more money. This was one reason that made it really hard for my family and me to pay the $6,000 before each semester. But this did not affect my plans for a future in journalism, a career known for little pay and benefits. I choose happiness over money, which may or may not bite me in the end, but I’m confident in myself to make a stable career in my chosen field. Does this add to my worries? Absolutely. I’ve settled with the idea of paying the minimum amount of my loans every month for the rest of my life, because I understand my career may not help me to pay them off sooner. I definitely take my loans into consideration when making purchases. Any time I think of investing money in a nice vacation, I have to stop and remind myself that it might be a better decision to save that money for loan payments following graduation.

How would Warren’s plan affect you? I will be partially relieved [of debt, based on family income]. Incomes are baseless in my opinion. My family has accrued so much debt over the years that income per year means nothing anymore, and it’s sad that such a wonderful plan like this one is based on something [income] that has so many faces to it. But I guess it’s the only way to make it fair and applicable to the whole country.

Comments & Discussion

Boston University moderates comments to facilitate an informed, substantive, civil conversation. Abusive, profane, self-promotional, misleading, incoherent or off-topic comments will be rejected. Moderators are staffed during regular business hours (EST) and can only accept comments written in English. Statistics or facts must include a citation or a link to the citation.